Future of Fraud Prevention: Stay Ahead of Fraud Threats in 2025 and Beyond

November 5th, 2024

Financial institutions (FIs) are facing unprecedented challenges as fraud evolves. As criminals take advantage of new technologies, banks and other financial institutions need to leverage cutting-edge solutions to stay ahead. A proactive approach to fraud prevention, rooted in real-time monitoring, collective intelligence, and advanced analytics, is essential to safeguard customers and their assets.

The Evolving Fraud Landscape

Fraud has taken on new forms as digital channels became more prominent. From flash fraud to mule accounts, bad actors are finding ways to exploit gaps in traditional fraud prevention models. For FIs, this means that outdated strategies are no longer enough.

Criminals are targeting digital banking more than ever. Firms need a future-proof solution that tackles fraud across payment types and channels and anticipates emerging threats.

Some of the biggest challenges FIs face include:

- Flash fraud attacks: Quick, coordinated schemes that attack program vulnerabilities and result in huge losses over a short time

- Account takeover (ATO): Fraudsters leverage stolen credentials to gain access to accounts

- Scams: Fraudsters manipulate individuals into providing them money directly

- Mule accounts: Used by criminals to move illicit funds, often going unnoticed

The Power of Real-Time Data Integration

A key to preventing fraud in today’s environment is integrating real-time data from a variety of sources. By connecting the dots in real time, FIs can detect unusual behavior patterns that may signal fraud. Using AI and machine learning helps flag potential issues before they result in financial loss. FIs can:

- Integrate data feeds from multiple sources to stay ahead of evolving threats

- Leverage machine learning to detect abnormal behaviors that indicate fraud

Stopping Flash Fraud with Advanced Analytics

Flash fraud attacks are designed to exploit the speed of digital transactions. These attacks require immediate response and adaptive measures. FIs can stay ahead by using analytics-driven tools that monitor transactions in real time to uncover flash fraud patterns quickly, identify anomalies, and act instantly. Having flexible policy management and rule building allows financial institutions to immediately address flash frauds without waiting for model governance approval that typical machine learning models requirements.

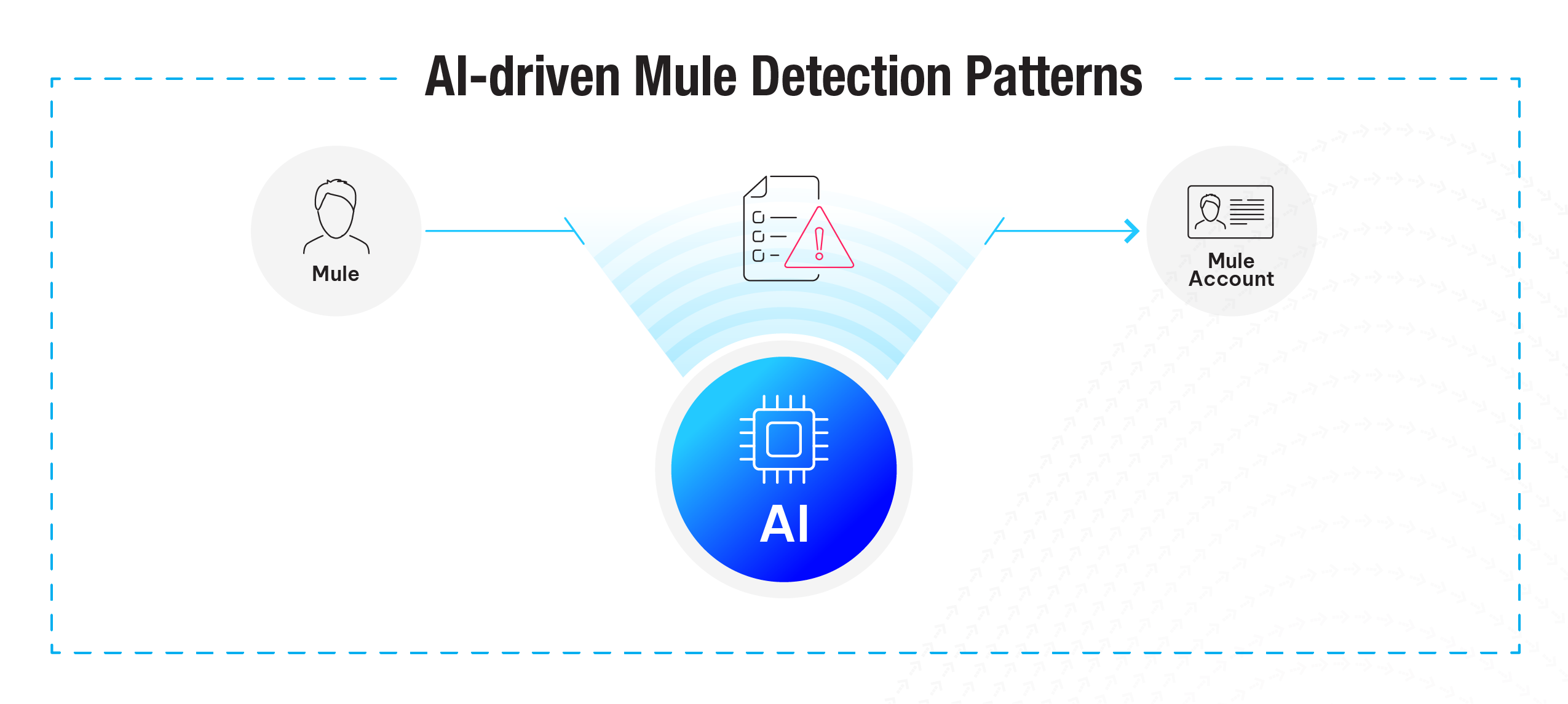

Detecting Mule Accounts with AI

Mule accounts play a critical role in money laundering schemes. Often, these accounts remain dormant for long periods, only to be activated for fraudulent purposes. Detecting these accounts requires sophisticated pattern recognition that only AI can provide. Firms can:

- Stop opening of mule accounts with application fraud controls

- Put in place early account monitoring to pinpoint signs of fraudulent use before mature behavior profiles can be developed

- Use AI to flag unusual activity associated with mule accounts

- Monitor inbound transactions for receipts of fraudulent funds

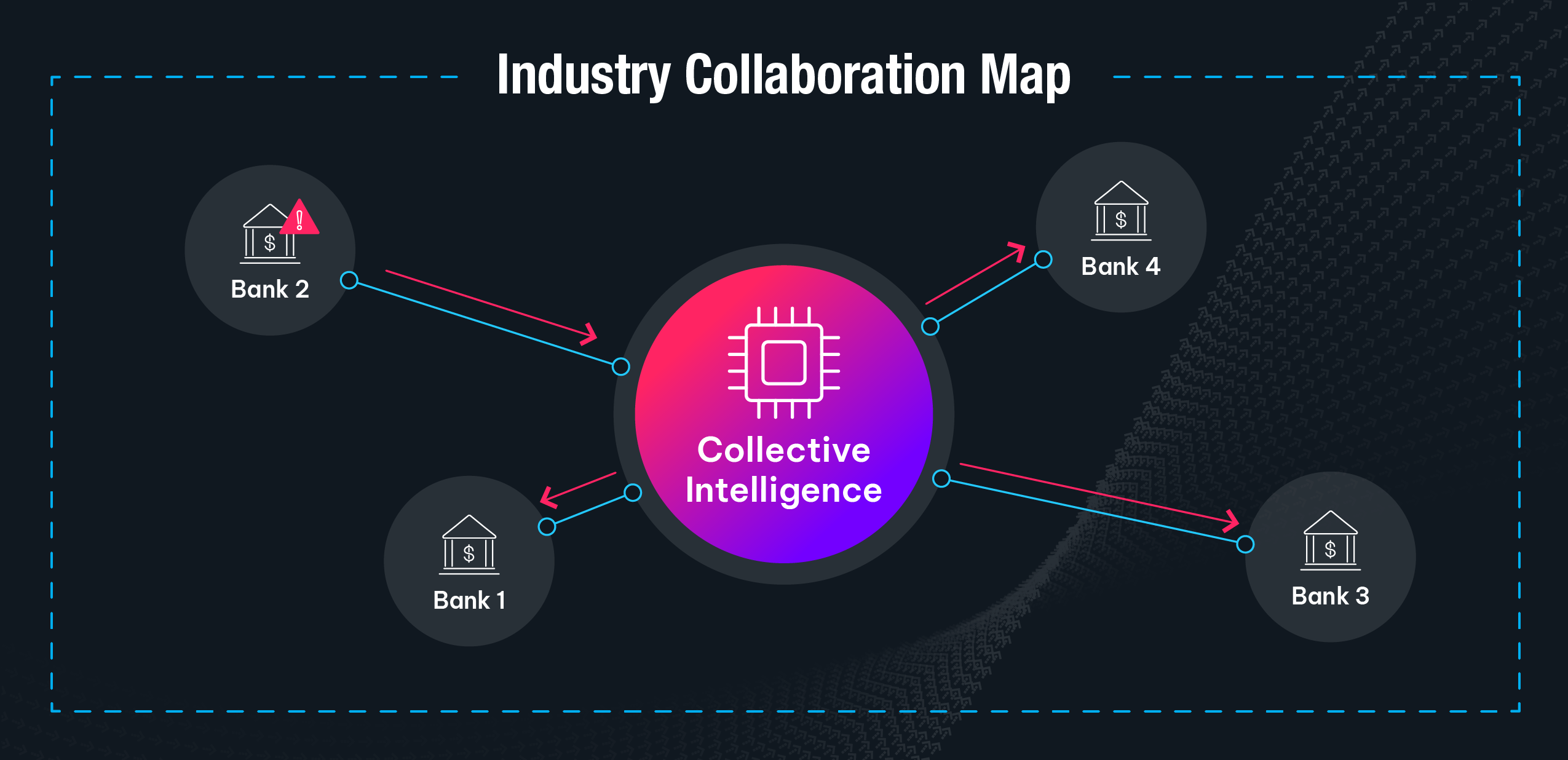

Collective Intelligence: A Collaborative Approach to Fraud Prevention

Harnessing collective intelligence can be a game changer for FIs. By sharing information across the industry, firms can recognize fraud patterns and trends that may be missed by any single financial institutions. This collaborative approach enables a faster and more efficient response to emerging threats. Some proven tactics to employ are:

- Sharing data across networks, using that to train models and identify large-scale fraud trends

- Collaborating with industry partners to pool insights and strengthen defenses, for example by identifying the collective fraud rate for payments to and from a certain bank

- Benchmarking performance, like fraud rates, against other financial institutions

Fraud Prevention Programs: A Systematic Approach to Combat Fraud

Fraud prevention programs are central to protecting firms from a growing array of sophisticated threats. These programs combine technology, policy, and education to ensure a strong line of defense against criminal activities. With an ever-changing threat landscape, FIs must continually evolve their fraud prevention strategies, building resilient frameworks that not only react to but also anticipate fraud attempts.

Key Components of Effective Fraud Prevention Programs

An effective fraud prevention program comprises several critical elements that help institutions identify risks, prevent attacks, and mitigate damages when breaches occur:

- Risk assessment and profiling: Continuously assess risk exposure by identifying high-risk customers and transactions

- Real-time transaction monitoring: Scrutinize transactions as they happen, identifying red flags like abnormal transaction sizes or rapid transfers

- AI-powered alerts and automation: Leverage artificial intelligence and machine learning to automate detection and issue immediate alerts

- Layered security protocols: Use multiple layers of security, from two-factor authentication to encryption, to protect against unauthorized access

- Customer education and awareness: Engage customers in fraud prevention by educating them on best practices like spotting phishing attempts and regularly monitoring their accounts

Continuous Improvement Through Data and Analysis

A well-designed fraud prevention program evolves based on data, trends, and feedback. FIs should regularly review the effectiveness of their fraud detection systems and adapt them to emerging threats. It’s crucial that fraud teams:

- Track and analyze trends: Regularly review fraud data to spot trends and adapt prevention measures accordingly

- Implement feedback loops: Use feedback from attempted or successful fraud incidents and fraud investigations to refine strategies and close gaps

- Test and adapt: Routinely test fraud defenses using simulated attacks to ensure resilience

How Firms Benefit from Comprehensive Fraud Prevention Programs

When FIs invest in robust fraud prevention programs, they safeguard their reputations, minimize financial losses, and maintain trust with their customers. A comprehensive approach helps reduce fraud-related costs while fostering an environment of security and reliability. The right approach will:

- Lower fraud-related losses: Proactive fraud prevention reduces potential financial damage and saves millions in recovery costs.

- Enhance customer trust: Strong fraud prevention programs protect assets and offer customers peace of mind

- Ensure regulatory compliance: Fraud prevention programs help institutions meet compliance requirements, avoiding penalties and ensuring legal adherence

- Strike the right balance between customer experience and friction: Providing friction only where necessary to not impede good customers’ normal business

Building a Future-Ready Fraud Prevention Program

FIs need to ensure their fraud prevention programs are future-ready. This means integrating advanced technologies like AI and machine learning, continuously educating customers and employees, and regularly updating internal processes to stay ahead of evolving threats.

- Embrace innovation: Adopt AI, machine learning, and advanced analytics as essential tools in your fraud prevention arsenal

- Educate continuously: Keep customers and employees informed about the latest fraud tactics and best practices

- Review and adapt: Regularly evaluate your fraud prevention measures, adjusting them to new threats, regulations, and industry developments

Fraud prevention programs form the backbone of an FI’s defenses against ever-evolving threats. By integrating real-time monitoring, AI-powered analytics, layered security protocols, and continuous risk assessments, FIs can stay ahead of bad actors and protect their customers. Combining these proactive measures with strong customer education ensures that firms remain resilient against fraud while fostering trust and reliability within the financial ecosystem.

Take the first step in strengthening your fraud prevention program with NICE Actimize’s comprehensive solutions. Learn how to protect your institution and customers from emerging threats.