Risk Appetite Framework vs. BSA/AML Program: How Are They Aligned?

January 2nd, 2025

The previous blog Risk Appetite Framework & BSA/AML Programs: What Comes First? explored what a Risk Appetite Framework (RAF) is from an organization-wide perspective and what is a BSA/AML program to highlight various differences and similarities associated with managing the overall organizational risk. This blog takes a deeper view into the many areas where the RAF and a BSA/AML program are interconnected with one another.

Now that the RAF and BSA/AML programs are defined, it’s understood that while they serve different purposes, they are also closely aligned in the context of risk management. A Risk Appetite Framework helps organizations determine the level of risk they are willing to accept. The RAF guides the design and implementation of all areas of risk, including a BSA/AML program, ensuring that these programs are in step with the organization’s risk tolerance. BSA/AML programs on the other hand, are a key component of an organization’s risk management framework, particularly in managing financial crime risks. These programs help institutions comply with regulatory requirements related to money laundering and terrorist financing to mitigate the risks associated with these activities. In the context of BSA/AML programs, risk appetite influences how financial institutions approach the identification, assessment, and mitigation of money laundering and terrorist financing risks. Here are various avenues in which a Risk Appetite Framework aligns with a BSA/AML program:

Risk Identification:

Risk identification is the foundational step in the risk management process within a RAF. It involves the systematic identification and categorization of risks that could impact the institution’s ability to achieve its objectives. This includes risks which can arise from both internal factors, such as operational inefficiencies, and external factors, such as regulatory changes or market volatility. Once identified, risks can be categorized into various categories including credit risk, market risk, operational risk, and compliance risk. Each category represents a different type of risk that the institution may face, requiring specific strategies for identification and mitigation.

From a BSA/AML program perspective, these risks categories could include customer-related risks, product risks, geographic risks, and transaction risks. Let’s review these to see how they align with the Risk Appetite Framework.

Customer-related risks involves the types of customers an organization is willing to do business with as different customer types pose varying risks to an organization. From an organization level, the RAF will ensure any customer type included aligns with the risk appetite the organization has set. For instance, if customer types such as Money Service Businesses (MSBs) and Marijuana Related Businesses (MRBs) fall within the risk tolerance these customers will be included and closely monitored. It is here where the BSA/AML program reviews the risks associated with these customer types and provides guidance on the types of risks they possess and if the organization can realistically manage the associated risks.

Product risks refer to the various products and services offered by a financial institution. These risks can vary based on the complexity, nature, and usage patterns of the products and services. Products with complex structures or features, may pose higher money laundering or terrorist financing risks due to the difficulty in understanding the underlying transactions or parties involved. In addition, the usage pattern of the products offered can play a big factor. Meaning the greater the volume of certain products or services the greater the need for monitoring.

Geographic risks include risks associated with the locations in which a financial institution operates or conducts business. These risks can vary significantly based on the jurisdiction’s regulatory environment, political stability, level of corruption, and effectiveness of AML/CFT (Combating the Financing of Terrorism) measures.

Transaction risks primarily relate to the potential for financial institutions to be used as a conduit for money laundering, terrorist financing, or other illicit activities. These risks can vary based on the nature of the institution’s customers, products, services, and geographic locations.

By identifying and understanding these risks, the institution can tailor its BSA/AML program to mitigate them effectively supporting the organizational strategy.

Risk Tolerance:

Risk tolerance is the level of risk that an organization is willing to accept or retain after considering its risk appetite, business objectives, and regulatory requirements. It represents the organization’s willingness to bear the impact of risk in pursuit of its strategic goals.

In the context of a Risk Appetite Framework, risk tolerance helps to translate the broader risk appetite statement into specific, measurable terms. It sets boundaries for risk-taking activities and guides decision-making processes. Risk tolerance can vary based on the type of risk, the organization’s risk management capabilities, and its overall risk culture.

From the RAF perspective this can be seen in certain areas where the institution has decided whether or not to onboard certain customer types, add certain products and services or even decide to operate in certain locations. The risk may be seen as too great and therefore the institution would likely opt out. In contrast, a review of these areas by BSA/AML can provide a different vantage point for risk tolerance. From a BSA/AML perspective, the risk may be seen as too risky or not able to mitigate the risk enough based on that particular customer type or products/services. For example, certain customer types such as Politically Exposed Persons (PEPs), Privately Owned ATMs and other customer types that may not be banked by all financial institutions. These customer types may not fall within the acceptable risk level of an institution and therefore not be included. On the other hand, if these risks do fall within the acceptable risk tolerance, then those could be included.

Above all, risk tolerance is not a static concept and may change over time based on internal and external factors. It is important for organizations to regularly review and reassess their risk tolerance to ensure it remains appropriate in light of changing business environments and risk landscapes.

Risk Assessment: A risk appetite guides the risk assessment process, helping institutions identify and prioritize areas of higher risk. By prioritizing these areas of higher risk, an organization can further support the resources required to manage them. In most organizations, BSA/AML programs conduct risk assessments annually. This assessment provides key information when assessing the maturity of a program and identifying any key areas that may require additional controls to mitigate the risks. A robust risk assessment process is critical for aligning the Risk Appetite Framework and BSA/AML program with the institution’s strategic objectives and regulatory requirements. It helps ensure that risks are identified, measured, monitored, and managed effectively to protect the institution from financial, legal, and reputational harm.

Risk Mitigation: Based on the risk appetite and risk assessment, the BSA/AML program implements controls and procedures to mitigate identified risks, ensuring they remain within the institution’s risk tolerance. Establishing the design of controls and mitigation of identified risks, whether it be from policies and procedures or from systematic means (Transaction Monitoring in the case of BSA/AML programs), is a key part of this process. Another key area seen for risk mitigation in relation to BSA/AML, is a culture of compliance. This can be seen with frontline or customer-facing employees who are encouraged to report activity seen as unusual or suspicious. Without a culture of compliance this can be very challenging for an institution to rely on these resources to help report and prevent occurrences in the future.

Monitoring and Reporting: The BSA/AML program continuously monitors transactions and activities for suspicious behavior. The RAF guides the reporting of significant risks that exceed the institution’s risk tolerance thresholds. Key Risk Indicators (KRIs) are used to provide an early signal of increasing risk exposures in various areas as defined by the organization. With recent technological advances, risks can be measured proactively, providing risk management teams with the tools to judge the institution’s tolerance for risk and create risk mitigation plans in case any issues arise. Key risk indicators for institutions can also help to track trends in the organization and these trends can be used to identify opportunities for future investment or to identify areas where the risk wouldn’t be worth the reward.

Resource Allocation: Risk appetite can influence the allocation of resources, such as personnel, technology, and capital, to manage BSA/AML risks effectively. Institutions which view compliance measures as a high priority are likely to employ more resources to manage and combat these risks than an organization who may not put as much emphasis in this area.

Additionally, optimizing an institution’s resource allocation is another valuable consideration within a RAF. To accomplish the optimization, a proactive approach is required that warrants a careful balancing act, ensuring that resources are allocated efficiently while maintaining compliance with regulatory requirements and meeting the institution’s business objectives. This involves:

- Regularly reviewing and updating the risk assessment to identify emerging risks and adjust resource allocation accordingly.

- Implementing a robust governance framework to ensure that resource allocation decisions are made at the appropriate levels within the institution.

- Monitoring and evaluating the effectiveness of resource allocation strategies to ensure that they are achieving the desired outcomes.

Alignment with Strategic Objectives: Strategic objectives are the overarching goals that guide a financial institution’s operations and decision-making processes. These objectives define the institution’s mission, vision, and values, and serve as a roadmap for its future growth and development. A Risk Appetite Framework (RAF) is a structured approach that defines the level of risk the institution is willing to accept in pursuit of its strategic objectives. On the other hand, a BSA/AML program is a set of policies, procedures, and controls designed to detect and prevent money laundering and terrorist financing activities. Benefits of the alignment of the RAF and BSA/AML program are:

- Alignment of strategic objectives within a RAF and BSA/AML program helps in prioritizing risks leading to improved risk management outcomes.

- By aligning risk management efforts with strategic objectives, financial institutions can ensure compliance with BSA/AML regulations, as risk management efforts are focused on areas critical to the institution’s success and compliant with regulatory requirements.

- Alignment of strategic objectives within a RAF and BSA/AML program provides a clear framework for decision-making, ensuring that risks are managed in a manner that supports the achievement of long-term goals.

Compliance Culture: Maintaining a culture of compliance is paramount to ensure the integrity and stability of any organization. When combined with a robust Risk Appetite Framework (RAF) and a comprehensive Bank Secrecy Act/Anti-Money Laundering (BSA/AML) program, institutions can effectively manage risks while adhering to regulatory requirements. In order for this to be effective senior leadership should demonstrate a strong commitment to compliance and provide regular training to raise awareness among all employees, including BSA/AML teams. In addition, establishing accountability and promoting transparency which helps in monitoring the compliance activities and processes.

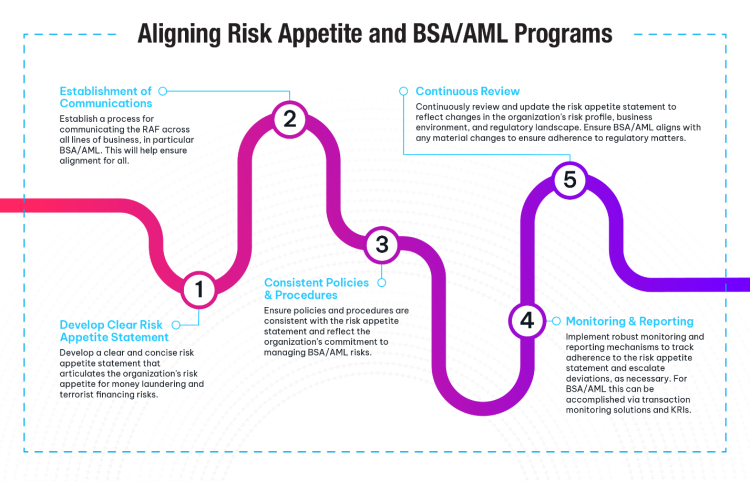

Aligning Risk Appetite and BSA/AML Programs

To effectively incorporate risk appetite into BSA/AML programs, financial institutions should consider the following steps:

In conclusion, while Risk Appetite Frameworks and BSA/AML programs are clearly distinct concepts within an organization, they are closely related in the context of risk management. A well-defined Risk Appetite Framework can help organizations align their BSA/AML activities with their overall risk management strategy, ensuring they effectively manage risks related to money laundering and terrorist financing while achieving their strategic objectives.

Above all, having a strong Risk Appetite Framework and BSA/AML program aligns institutions with the ability to adapt to the ever-changing industry standards and trends and having the right culture of compliance will have your organization pointed in the right direction for success.

For more information on NICE Actimize AML solutions that mitigate risk, go here.