Risk Appetite Framework & BSA/AML Programs: What Comes First?

December 9th, 2024

Although Risk Appetite Frameworks (RAF) and BSA/AML programs undoubtedly have an impact on each other’s objectives, they are independent components of an organization’s risk management framework with purposes that are distinct from each other. Understanding these differences and the similarities is critical for organizations to focus on both the risks associated with money laundering and funding of terrorist organizations and doing so in the context of its organization-wide risk management strategy.

Being sensitive to these risks and being flexible and adaptive in identifying and mitigating the risks that could result from working with certain customer types, helps to determine appropriate risk limits and safeguards are established within the BSA/AML program. These safeguards must ensure that risks associated with the BSA/AML program meet the overall risk appetite of the organization. In addition, it is important these safeguards are commensurate with the costs and benefits in establishing and managing an effective program.

This article explores the components of a Risk Appetite Framework within the context of the risks associated with a BSA/AML program to identify differences and similarities connected with managing the overall organizational risk.

Understanding the Risk Appetite Framework (RAF)

The Risk Appetite Framework is a comprehensive and structured methodology that outlines an organization’s overall philosophy and strategy for managing risk. The aim is to provide a high-level view of how organizations identify and manage risks across various business units, functions, and processes.

The RAF represents the risks an institution’s board of directors and management is willing to accept in order to pursue their strategic objectives. It provides guidance on the levels and types of risks considered acceptable and aligns the use of risks with an organization’s risk tolerance and policy objectives.

While the framework can be fairly similar in terms of the general structure across many organizations, the scope and details of what is included will vary greatly from one organization and industry to the next. It is here where an organization should establish their enterprise risks and subsequent intermediate risk categories. For example, what is important and critical to a financial institution may vary from that of a broker/dealer or even an insurance company. While these can be considered financial organizations, they have distinct differences when identifying and determining risk.

It is especially important to recognize and understand that Risk Appetite Frameworks are not one size fits all. This can be due to the many factors such as the size and maturity of an organization, the location or region an institution is located, types of customers and finally the various products and services offered. Once established, it is crucial to review on an ongoing basis to ensure risks reside within the tolerance level of your institution.

Objectives of a RAF:

The objectives of a Risk Appetite Framework for an organization are multifaceted. They reflect on its role in guiding risk management practices and aligning them with the organization’s strategic objectives and business plan set forth by the board of directors and management. Here are some key objectives of a Risk Appetite Framework:

Define Risk Tolerance: One of the primary objectives of a RAF is to establish the organization’s risk tolerance. For most financial organizations, this involves determining the acceptable level of risk exposure across various categories, such as credit risk, information technology risk, operational risk, and compliance risk to name a few. By clearly defining risk tolerance, the institution can ensure that its risk-taking activities are consistent with the overall risk appetite.

Align Risk with Strategic Objectives: Every organization should have defined strategic objectives which can change over time due to many factors. A RAF helps align risk-taking activities with the institution’s strategic objectives and business plan. By identifying and quantifying the risks associated with each strategic objective, an institution can make informed decisions about which risks to accept, mitigate or avoid. This alignment ensures that risk management is integrated into the institution’s strategic planning process including a BSA/AML program.

Enhance Risk Awareness: Having a culture of risk awareness is key for any organization and it must come from the top. A RAF helps promote a culture of compliance, including risk awareness, throughout the organization. By clearly communicating the institution’s risk appetite and tolerance, employees at all levels gain a better understanding of the risks the organization can encounter and their role in managing them. Increased and continued awareness of these risks helps to not only prevent and mitigate risks it also aids in reducing the likelihood of costly fines and reputational damage caused by these incidents.

Improve Decision-Making: Having the right information at the right time is vitally important when assessing risk and determining which direction is the most advantageous for any situation. This is particularly true of the RAF, which provides a framework for risk-based decision-making. By establishing clear guidelines for assessing risks and determining appropriate risk responses, an organization can make consistent and effective decisions. Improving the overall decision-making outcome and reducing potentially costly errors increases the reliability of these decisions for the institution as a whole.

Enhance Risk Oversight: As previously noted, the tone at the top is one of, if not, the most important part for any institution’s success. The importance of risk oversight should be firmly within the purview of top-level management and the board of directors for any organization, in particular in the financial services realm. A RAF enhances the institution’s management ability to oversee and monitor its risk profile.

Establish various Key Risk Indicators (KRIs) allows an organization the ability to determine its risk exposure from a multitude of areas and track the performance against its risk appetite. This enables management and the board of directors to provide fast and effective oversight and make timely adjustments to the risk management strategy based on current information. Without the RAF, knowing what and when to measure can be an almost impossible task to overcome.

Align Regulatory Requirements: For financial institutions and other highly regulated organizations, compliance is one the primary focus areas of the organization. Without it, these organizations are exposed to a number of risks, including credit, operations, market and liquidity. The RAF helps ensure compliance by providing a structured methodology to risk management. By aligning risk management practices with regulatory requirements, the institution can demonstrate its commitment to internal sources such as Internal Audit, the board of directors and also external sources, such as regulators that sound risk management practices are being employed. This helps reduce the risk of regulatory sanctions which can be very costly on many fronts and hinder progress of an organization to expand.

Drive Performance: Ultimately, the goal of a RAF is to drive performance by enabling the institution to take calculated risks that support its strategic objectives. By providing a framework for managing risks in a systematic and disciplined manner, a RAF helps the institution achieve its goals while protecting its reputation and stakeholders’ interests.

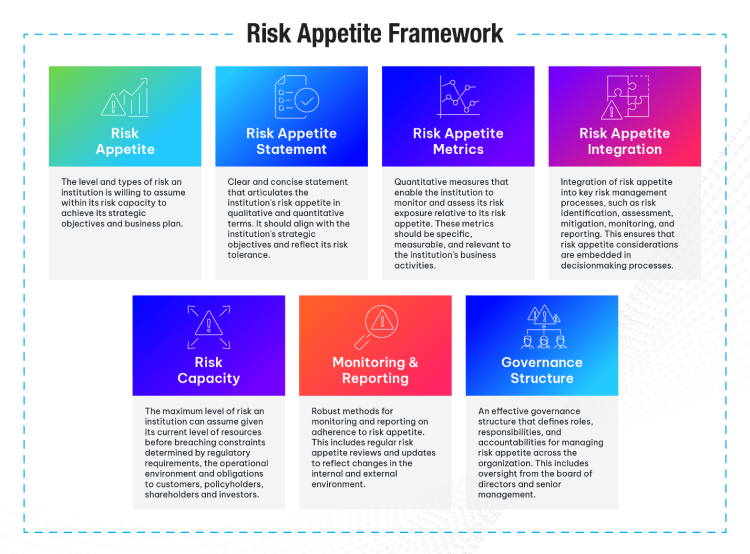

Components of a RAF

A Risk Appetite Framework typically includes a risk appetite statement, risk capacity, governance structure, integration with risk management processes, and monitoring and reporting mechanisms. The RAF should include an outline of the roles and responsibilities for those overseeing the implementation and monitoring of the RAF. The RAF should also consider material risks to the institution, as well as to the institution’s reputation versus customers, investors, and shareholders. A comprehensive Risk Appetite Framework consists of several key components, including:

BSA/AML Programs

What is a BSA/AML Program?

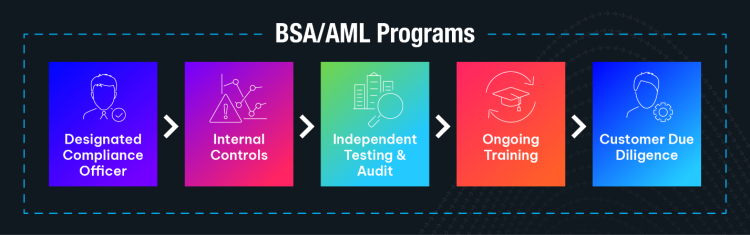

Compliance is not just a requirement in an organization, it is the cornerstone of confidence and stability that expands well beyond the walls of an organization. One major aspect of compliance at any financial institution, regardless of size, is the adoption of and continued adherence of a Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) program. A BSA/AML program should be primarily based on the five (5) pillars, each of which plays a vital role in protecting against money laundering, terrorist financing, and other illegal activities. With the pillars as a base, other components in a BSA/AML program should include establishing and maintaining a set of policies, procedures, and controls that a financial institution must implement to comply with the BSA and AML regulations. The program is designed to identify and mitigate the risks of money laundering and terrorist financing within the institution. Let’s explore some of the essential pillars and components of a BSA/AML program and the importance of each in relation to a Risk Appetite Framework.

Designated BSA Compliance Officer: Each institution must appoint a qualified and experienced individual to oversee the overall practice of AML regulations throughout the organization. This individual is responsible for compliance with the BSA/AML regulations, including the development and implementation of the AML program. The BSA Compliance Officer serves as the primary point of contact for all AML-related matters and is responsible for ensuring that the organization complies with all legal and regulatory requirements.

Internal Controls: Institutions are required to establish and maintain adequate written policies, procedures and internal controls designed to ensure adherence with the BSA/AML regulations. These documents, required for all applicable lines of business, should outline the institution’s approach to compliance and alignment with the Risk Appetite Framework risk-based approach to AML compliance detailing how your organization will identify, monitor, and report suspicious activity. Policies should be regularly reviewed and updated to reflect changes in risk tolerance at the organization level and any changes from a regulatory perspective.

As a part of the control’s component, BSA/AML programs must also conduct a comprehensive risk assessment of the money laundering and terrorist financing risks they face. This assessment helps institutions identify high-risk areas and tailor their compliance efforts accordingly.

Independent Testing and Audit: To ensure the effectiveness of the AML process, institutions are required to conduct independent audits and tests on a regular basis. These reviews should be conducted by qualified internal and external auditors to identify any weaknesses or deficiencies in the system and to assess the organization’s compliance with BSA/AML regulations, and the effectiveness of its AML processes. In most organizations, a risk-based approach to review high-risk sectors may be performed more frequently than those considered low to moderate risk for the organization. Just like with the Risk Appetite Framework at the organization level, the board and management should be fully aware of all aspects of the audits and which allows them to take appropriate action to address the deficiencies identified.

Ongoing Training: A key component of any effective AML program is ongoing training for employees. Organizations should provide regular employee training on identifying and reporting suspicious activity, as well as the organization’s AML policies and procedures. This training helps ensure that employees are aware of their responsibilities and can effectively identify and prevent money laundering and terrorist financing activities. More focused training for AML professionals is also needed as this training should focus on emerging industry trends and other AML related activities critical for identifying suspicious activity. Above all, without a culture of compliance as directed by a Risk Appetite Framework, this training can become ineffective and lead to unwanted risks.

Customer Due Diligence (CDD): Institutions must establish and maintain risk-based processes for conducting due diligence of customers, including identifying and verifying customers and monitoring consumer behavior. Furthermore, the institution should conduct proper due diligence on a routine basis of identified high-risk customers, such as politically exposed persons (PEPs) and non-resident customers. These factors help ensure that organizations can better identify and mitigate the risks associated with all known high-risk customer types.

Objectives of a BSA/AML Program

The primary purpose of any BSA/AML program is to detect and prevent money laundering and terrorist financing activities. The importance of this to protect the institution and the financial system from being abused for illicit and illegal purposes. These programs help organizations stay and remain in compliance with the various regulatory requirements. Above all, this helps demonstrate, along with a Risk Appetite Framework, to internal and external sources the commitment of the organization in combating financial crime.

Let’s explore the key objectives of a BSA/AML program and why they are critical for institutions.

Detect and Prevent Money Laundering and Terrorist Financing: The primary objective of a BSA/AML program is to detect and prevent money laundering and terrorist financing activities. Organizations are required to implement policies, procedures, and controls to identify and mitigate the risks associated with these illicit activities as seen in the pillars of a BSA/AML program. By monitoring transactions and customer behavior, institutions can work to detect suspicious activities and report them to the relevant authorities.

Ensure Compliance with Regulatory Requirements: Another key objective of a BSA/AML program is to ensure compliance with regulatory requirements. Institutions must adhere to the BSA/AML regulations, as well as guidelines issued by regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN) and the Office of Comptroller of the Currency (OCC), for U.S. institutions. A robust and well-executed BSA/AML program helps institutions meet these requirements and avoid potential penalties and sanctions. Aside from monetary penalties, not staying in compliance can result in many penalties including preventing an organization from expanding into new areas or markets and products/services thus thwarting growth and expansion.

Protect the Institution’s Reputation: Money laundering and terrorist financing activities can harm an institution’s reputation and erode customer trust. By implementing effective BSA/AML programs, institutions can demonstrate their commitment to combating financial crime and protecting their reputation. This, in turn, can help attract and retain customers and business partners thus positively impacting the capital of an organization.

Mitigate Financial and Legal Risks: Failure to prevent money laundering and terrorist financing can expose institutions to significant financial and legal risks. These risks include monetary penalties, regulatory sanctions, and reputational damage. A BSA/AML program helps mitigate these risks by identifying and addressing potential vulnerabilities in the institution’s operations.

Enhance Risk Management Practices: A BSA/AML program is an integral part of an institution’s overall risk management framework. By identifying and assessing the risks of money laundering and terrorist financing, institutions can implement appropriate controls to mitigate these risks. This enhances the institution’s ability to manage its overall risk profile effectively.

Promote a Culture of Compliance: A strong BSA/AML program, in conjunction with a Risk Appetite Framework, helps promote a culture of compliance within the institution. By providing training and guidance to employees, institutions can ensure that all staff members understand the importance of compliance and their own responsibilities regarding BSA/AML. This helps create personal ownership—knowing what individuals do can make a difference and promotes a cohesive approach to compliance throughout the organization.

RAF Sets an FI’s Risk Appetite

A Risk Appetite Framework for any institution aims to provide a clear understanding of the institution’s overall risk tolerance by aligning risk-taking activities with strategic objectives. This provides the organization the ability to make more informed decisions, guide resource allocation, enhance stakeholder confidence, and promote a risk-aware culture.

In contrast, while a BSA/AML program is a critical component of any institution’s risk management program, its main objective is to combat financial crime and protect the integrity of the financial system. By detecting and preventing money laundering and terrorist financing and ensuring compliance with regulatory requirements, a BSA/AML program helps institutions achieve their overall strategic objectives while safeguarding the financial system.

In summary, the RAF sets the institution’s overall risk appetite and ultimately “the starting point.” The BSA/AML risks are a product of the RAF as the BSA/AML program operationalizes the risks by identifying, assessing, mitigating, and monitoring these risks within the defined risk appetite boundaries of the organization.

For more information on NICE Actimize’s AML solutions that mitigate risk, go here.