Evaluating Effectiveness: The Impact of a Rules Coverage Assessment on Transaction Monitoring Solutions

June 13th, 2024

In the ever-evolving landscape of financial services, banks are under constant pressure to not only fortify their defenses against illicit activities, such as fraud and money laundering, but also keep them up to date. Transaction monitoring solutions, powered by sophisticated algorithms and rule sets, are instrumental in detecting and alerting on these financial crimes, making it more difficult for the criminals to move their illicit wealth. However, the efficacy of such systems relies heavily on the comprehensiveness and relevance of the rules they employ. This article explores the regulatory framework addressed by rules and the key components of a rule coverage assessment for a bank’s transaction monitoring solution and the far-reaching impact and benefits it can have on financial crime detection for an organization.

BSA/AML Regulatory Framework:

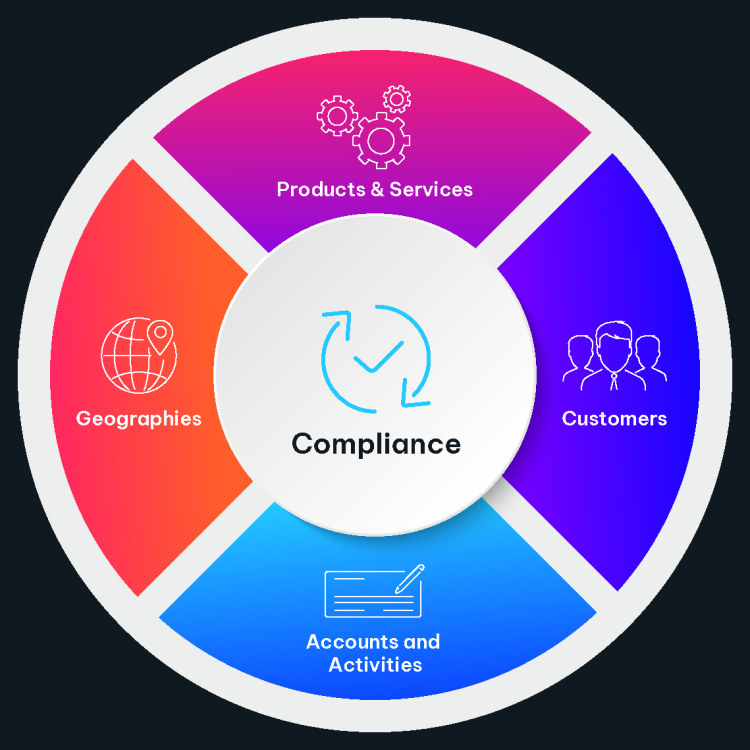

Regulatory authorities, such as FinCEN, require banks to have an effective BSA/AML compliance program in place. To measure the effectiveness of such a program, financial institutions must routinely conduct an Enterprise-Wide Risk Assessment (EWRA). This process involves the identification, analysis, and mitigation of potential risks that may impact the institution’s financial health and reputation. These risks can range from credit and market risks to operational and compliance risks. A comprehensive risk assessment enables institutions to make informed decisions, strengthen controls, allocate resources efficiently, and navigate uncertainties that include the following areas.

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD): Institutions are expected to understand their customers and the risks associated with their transactions. This involves implementing robust CDD procedures and, when necessary, applying EDD measures to high-risk customers.

Geographic Risk: Different regions present varying levels of money laundering and terrorism financing risks and concerns. BSA/AML risk assessments should consider the geographic locations in which financial institutions operate or conduct transactions.

Products and Services Risk: Financial products and services are exploited for illicit purposes, with some higher risk than others. Institutions must assess the inherent risks associated with their offerings and implement controls to mitigate these risks.

Internal Controls and Governance: The effectiveness of internal controls and governance structure is crucial in mitigating BSA/AML risks. Institutions should assess the adequacy of their policies, procedures, and training programs to ensure compliance.

Transaction Monitoring: As previously mentioned, effective transaction monitoring systems are critical for identifying and reporting suspicious activities. BSA/AML risk assessments should evaluate the adequacy of these systems and their ability to detect unusual patterns or anomalies. It is here where we further explore this component of the EWRA and the detail a Rule Coverage Assessment provides a bank to ensure their transaction monitoring solution is effectively mitigating risks based on their rule selection.

Understanding Rule Coverage Assessment:

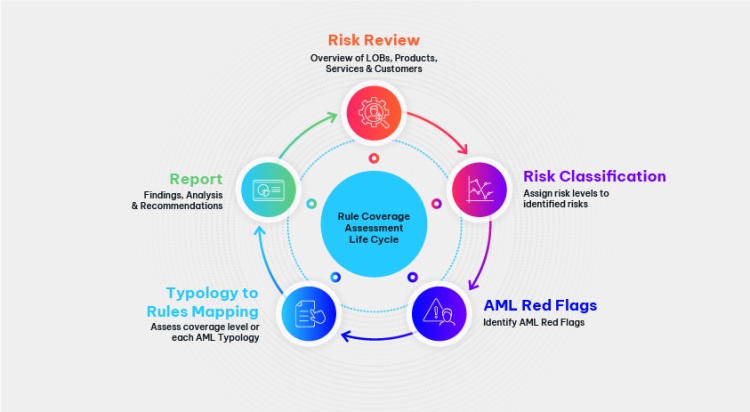

A Rule Coverage Assessment involves the thorough examination of the rules implemented within a transaction monitoring solution. This includes alignment of rules with identified risks, understanding of the rule functionality including criteria and thresholds set for triggering alerts, and addressing emerging risks. These rules, often designed to identify suspicious patterns and behaviors, are the frontline defense mechanisms that financial institutions employ to safeguard their operations and maintain regulatory compliance. Ensuring the correct rules are activated to address the various risks a financial institution is exposed to is paramount. To understand what a rule coverage assessment is, let’s first begin by understanding the components involved.

Key Components of Rule Coverage Assessment:

The assessment should evaluate whether the rules, given their line of business and financial products offered, adequately address the bank’s risk landscape and risk appetite to ensure adherence with regulatory requirements. Additionally, a rule coverage assessment should complement the larger, more comprehensive EWRA, which identifies threats, critical risks, and impacts that should be considered when pursuing the overall mission and objectives of the organization.

Risk Review and Identification

To perform the assessment, a review of the various risk categories associated with BSA/AML must first be performed. These categories generally include products and services, customers and entities, and geography and channels. A breakdown of these categories includes:

Products and services

These should be assessed based on the types offered, taking into consideration whether transactions are conducted domestically and/or internationally including the volume for each type. For instance, wire transfers, both domestic and international, can present high-risk money laundering concerns especially if they involve high volumes of activity. In contrast, if a financial institution does not maintain typical retail accounts such as checking, savings and CDs, then risks associated with deposit accounts would not present similar concerns given this is not offered by the bank.

Customer types and entities

These are generally divided into two main categories, legal entities and individuals. Financial institutions typically work with several legal entities and can include a wide range such as cash-intensive businesses, charities, Money Services Businesses (MSBs) and Commodities businesses and global trade based businesses. Additionally, customer types include individuals who may be further categorized as a Politically Exposed Persons (PEPs), non-resident alien (NRA), foreign customers and even power of attorney (POA). Each type of customer should be evaluated by the financial institution to understand the unique qualities and risks they have. A key factor in understanding the risks these customer types and entities may possess is the total volume each customer type compared to the overall customer base and even the dollar amount of their transactions. For instance, the greater the volume of PEPs or MSBs a financial institution maintains, the greater the risk that may be placed on the financial institution.

Geography is another main area a financial institution should consider when assessing risk. If a financial institution is in a single jurisdiction, the risks involved may be less compared to another organization located in multiple jurisdictions. Geography should also be considered when looking at where an organization’s customers are located and/or doing business. For example, foreign based customers located in a high-risk jurisdiction poses increased risk compared to those customers who are domestically based.

Channels are methods by which a bank may provide, to customers of a bank or other financial intuitions to conduct, a range of financial transactions and include such things as branch banking, mobile banking, and ATMs. In recent years, new channels have created additional and unique challenges. For instance, the use of the internet to open banking accounts, non-face-to-face, is a challenge and must be assessed for the additional risks compared to the traditional in-person method of opening accounts.

Risk Classification is then conducted once the categories have been identified, to assign a risk level to each identified risk which will aid in determining the amount of coverage needed for that respective risk. In classifying the risk levels, consideration should be made if the risk category is new or existing to the organization. If existing, it is likely there is risk coverage and therefore controls such as rules may already be in place to monitor. If the risk is new, it will likely have an elevated risk score as controls may not be as mature or even exist at that point. Another factor in determining the risk level, aside from a new or existing risk, is the volume of customers or even the number of transactions for that given risk. For example, a financial institution with very few PEPs may not require a higher risk level given the lower volume compared to the overall customer base while a financial institution that conducts a high volume of international wire transfers may very well be identified as high level given the volume conducted on a daily/monthly basis.

Above all, identifying and classifying all relevant risks aids in providing the foundation for a successful rule coverage assessment. Without this, it would be nearly impossible to ensure the level of each is adequately managed via transaction monitoring rules that are designed to detect potentially suspicious activity. Every organization will vary in what is considered high, moderate, and low and the important point is to ensure those making the risk level determination has a thorough knowledge of each line of business being evaluated.

AML Red Flags Mapping

Once the risks are identified and classified, it’s crucial to evaluate the BSA/AML Red Flag scenarios which are derived from various industry sources such as the FFIEC, FATF Red Flags, FinCEN and the OCC among others. These scenarios provide a financial institution with a list of red flags that should be considered as part of a comprehensive assessment of AML risks. Given the list of red flags can be lengthy, it is a good practice to separate those which can be covered by transaction monitoring and those which cannot be covered (Non-TM). This is because many scenarios involve activity that is non-transactional, such as a customer providing an ID that cannot be readily verified. While important information to capture, this does not involve any transactions and therefore would not be captured in the transaction monitoring solution.

As the relevant red flags are identified, it is important to document the current controls in place to mitigate the risks. It may be possible for certain manual controls to provide some level of coverage and may be implemented as part of First Line and Second Line BAU Procedures from the financial institution. For the purposes of the rule coverage assessment, the primary focus is on the monitoring of the applicable red flag scenarios based on the FI’s implemented transaction monitoring solution. In this case, the focus is to identify the level of coverage for each relevant scenario to the current transaction monitoring rule set to determine what is covered and if any gaps are identified.

Once the applicable red flags have been identified, a financial institution can evaluate whether the current rules align with the specific risks and activities the financial institution faces. Relevance ensures that the transaction monitoring system is focused on detecting scenarios that pose a genuine threat.

Rule Assessment Output

After gathering of the data and analysis of the findings has been completed, the financial institution should have a comprehensive report providing the details of the above noted actions/activities, the analysis performed including any gaps identified and finally recommendations on rules to add or remove, and any other noteworthy information which supports the findings. This is crucial for any organization in that it provides evidence to internal audit and certainly industry regulators, the completion of an assessment. This type of activity aids in the overall BSA/AML program in showing a proactive approach to mitigating risks and identifying emerging risks.

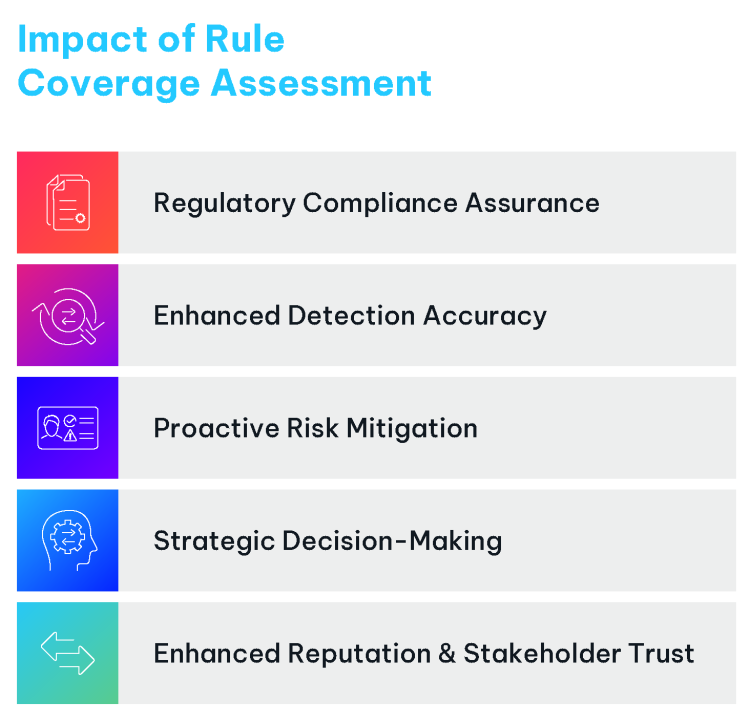

Regulatory Compliance Assurance

Regulatory expectations for robust BSA/AML compliance programs are high, and assessments play a critical role in meeting these expectations. Regular assessments ensure that the transaction monitoring system aligns with the latest regulatory requirements. This not only helps avoid potential penalties but also establishes a culture of proactive compliance, fostering a positive relationship with regulatory authorities.

Enhanced Detection Accuracy

One of the primary benefits of conducting a BSA/AML rule coverage assessment is the improvement in detection accuracy. By aligning rules with the specific risks identified in the bank’s risk assessment, financial institutions can enhance their ability to identify and investigate suspicious activities. This precision not only streamlines investigative efforts but also reduces the likelihood of false negatives, ensuring that potential threats do not go unnoticed.

Proactive Risk Mitigation

The financial landscape is dynamic, with new risks and evolving tactics employed by criminals. A rule coverage assessment ensures that the transaction monitoring system remains adaptable to emerging threats. By actively addressing gaps and weaknesses in the rule set, financial institutions can proactively mitigate risks, staying one step ahead of potential challenges.

Strategic Decision-Making

The insights gained from a BSA/AML rule coverage assessment provide a strategic advantage. Institutions can make informed decisions regarding the refinement of existing rules, the addition of new rules, or the adaptation of thresholds. This data-driven approach to decision-making enhances the overall effectiveness of the institution’s anti-money laundering efforts.

Enhanced Reputation and Stakeholder Trust

A robust BSA/AML compliance program, supported by regular rule coverage assessments, enhances the institution’s reputation. Stakeholders, including customers, investors, and regulators, place a premium on institutions that demonstrate a commitment to financial integrity. This trust can be a valuable asset in a competitive financial landscape.

Adaptive Rule Coverage:

Conducting a BSA/AML rule coverage assessment is a proactive measure that empowers financial institutions to enhance their transaction monitoring systems continuously. By aligning rules with current risks, optimizing thresholds, and ensuring adaptability to emerging threats, banks can stay ahead in the ongoing battle against financial crime. A thorough and well-documented assessment not only strengthens the bank’s compliance efforts but also contributes to the overall resilience of the financial system. In an environment where risks evolve rapidly, the commitment to a robust and adaptive rule coverage assessment is key to maintaining the integrity and security of the global financial ecosystem.

To learn more about NICE Actimize’s AML solutions, go here.