ESG Risk Management: Integrating AML with Environmental Social Governance

February 19th, 2025

In recent years, the growing emphasis on Environmental, Social, and Governance (ESG) criteria has reshaped how businesses operate across various industries. As regulatory frameworks evolve, organizations are increasingly integrating ESG factors into their decision-making processes to not only meet stakeholder expectations but also mitigate risks. One area where this integration is gaining significant attention is Anti-Money Laundering (AML) practice as it aligns with the broader push for responsible and sustainable financial practices. The convergence of ESG and AML presents a unique opportunity to strengthen financial crime prevention efforts while aligning with global sustainability goals. In this blog we will explore the integration of ESG in AML framework, highlighting how financial institutions can integrate these critical components to enhance compliance, promote ethical practices, and create long-term value. Lastly, we will analyze how Actimize can help Financial Institutions (FI) to understand requirements, adapt ESG risk management processes, and transform their activities while remaining both efficient and compliant.

What is ESG?

ESG stands for Environmental, Social, and Governance1. It refers to a set of criteria used to evaluate how an organization or investment performs in terms of sustainability and ethical impact. These three pillars provide a framework for assessing how companies manage risks and opportunities related to environmental, social, and governance factors. ESG factors are increasingly being used to guide investment decisions, risk management strategies, and regulatory policies.

Here’s a breakdown of the three components:

- Environmental: Environmental risks relate to how a company manages its environmental impact, including its carbon footprint, energy usage, waste management, and sustainability initiatives.

- Social: How a company manages relationships with employees, suppliers, customers, and the communities where it operates. This includes labor practices, diversity and inclusion, human rights, and consumer protection.

- Governance: The system of rules, practices, and processes by which a company is directed and controlled, including corporate governance, executive compensation, board diversity, and anti-corruption measures.

Evolution of ESG in the Financial Crime World

ESG has gained significant momentum in the financial sector in recent years, with investors and regulators focusing on both the positive aspects of ESG (e.g., promoting sustainability and social responsibility) and the risks associated with ESG non-compliance or misconduct, which can overlap with financial crime concerns. Here’s how ESG is evolving in the world of financial crime:

1. ESG and Anti-Money Laundering (AML):

- Financial institutions are increasingly required to assess the potential risks posed by entities that fail to adhere to ESG principles. Companies or individuals involved in activities that harm the environment or violate human rights (e.g., illegal mining, forced labor, or corruption) could be flagged as higher risk for money laundering.

- Some jurisdictions require companies to conduct “ESG due diligence” to identify hidden financial crimes or risks. For example, a company involved in illegal environmental practices may be linked to money laundering schemes. Environmental crimes, such as deforestation, illegal mining, and waste dumping, generate significant illicit proceeds. Money laundering associated with environmental crimes contributes to corruption, organized crime, and ecological harm, making ESG-linked AML initiatives a priority.

2. Integration into Risk Management:

- Financial institutions are increasingly integrating ESG criteria into their overall risk management frameworks. This helps them identify potential exposure to financial crimes that may arise from ESG-related misconduct.

- Incorporating ESG-related risks into financial crime compliance (AML, fraud, corruption, etc.) allows for a more holistic approach to identifying risks, avoiding fines, and protecting investors and stakeholders.

3. Regulation and Enforcement:

- Governments and international bodies are stepping up the regulation of ESG standards and enforcing penalties for violations. For example, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD) are pushing for more transparency and accountability, indirectly reducing financial crime risks tied to non-compliance.

- There is also a European Union legislative proposal Corporate Sustainability Due Diligence Directive (CSDDD) aimed at ensuring companies operate responsibly regarding human rights and environmental impacts throughout their supply chains. It sets out obligations for businesses to identify, prevent, mitigate, and remedy adverse effects on people and the planet. The CSDDD marks a significant step toward corporate accountability, ensuring businesses contribute to sustainable development by respecting human rights and protecting the environment.

- Financial crime regulators may now be more likely to investigate companies for financial crimes linked to their ESG failures or misrepresentations, especially if they impact investors, consumers, or global sustainability goals. Some of the regulators focusing on this are:

- Securities and Exchange Commission (SEC): The SEC has intensified its focus on ESG disclosures, ensuring companies provide accurate and transparent information. Misleading ESG claims, often referred to as “greenwashing,” can lead to investigations under securities fraud statutes.

- Financial Crimes Enforcement Network (FinCEN): Monitors money laundering risks, which may include ESG-related financial activities.

- Individual EU countries have regulators (e.g., BaFin in Germany, AMF in France) that investigate ESG-linked financial misconduct.

- European Securities and Markets Authority (ESMA): Ensures compliance with the EU’s Sustainable Finance Disclosure Regulation (SFDR) and investigates misrepresentations in ESG disclosures.

- Financial Conduct Authority (FCA): Focuses on greenwashing and investigates ESG claims to ensure they meet financial promotion standards and protect investors.

- Monetary Authority of Singapore (MAS): Enforces ESG-related financial regulations in Singapore.

- Financial Action Task Force (FATF): Sets standards for combating money laundering and terrorism financing, which can intersect with ESG-related crimes.

Some examples of financial crime in ESG

1. Greenwashing and Financial Crime:

- Greenwashing refers to the practice of misleading consumers or investors by falsely claiming environmental responsibility or sustainable practices. This can be viewed as a form of fraud or misrepresentation.

- Investors and regulatory bodies are becoming more vigilant about companies that falsely market themselves as sustainable or ESG-compliant without taking substantial action, potentially resulting in legal penalties, financial sanctions, or reputational damage.

Example:

A financial institution launches a “green” investment fund, claiming that the fund exclusively supports environmentally sustainable projects, such as renewable energy, reforestation, or clean technology. The institution markets the fund aggressively, attracting investors who are eager to support environmental causes.

However, behind the scenes, FI is engaged in:

- Misallocation of Funds: The fund is secretly channeling a significant portion of the investments into non-environmental or even harmful industries, such as fossil fuels, mining, or deforestation projects.

- Money Laundering: Some of the investments in the fund are traced back to illicit sources, such as organized crime or corruption. The green fund serves as a front to “clean” dirty money, making it appear legitimate.

- Fraudulent Claims: The institution provides fake reports and certifications to investors, exaggerating the environmental impact of its projects. Third-party auditors may even be bribed to validate false claims.

2. ESG-related Corruption and Bribery:

- There is increasing concern about corruption in the implementation of ESG standards. For instance, companies or governments may engage in bribery to gain ESG-related certifications or contracts, such as those for renewable energy projects or socially responsible initiatives.

- The financial crime aspect could involve misappropriation of funds meant for social or environmental projects, or corruption within governmental ESG-related procurement processes.

Example:

A company seeks to obtain ESG certification for a large-scale infrastructure project, such as a hydropower dam, which it markets as a sustainable and green energy initiative. ESG certification is crucial for attracting environmentally conscious investors and securing government subsidies.

How Corruption and Bribery Come into Play:

- Bribing Inspectors: The company bribes third-party ESG auditors or consultants to approve its project as compliant with environmental and social standards, despite significant issues like deforestation, forced displacement of local communities, or harm to biodiversity.

- Government Corruption: The company pays bribes to government officials to expedite permits and approvals, bypassing environmental impact assessments or community consultations required by law.

- False ESG Reports: The company falsifies sustainability data, claiming reduced carbon emissions, renewable energy use, or fair labor practices, and pays off certifying agencies to overlook discrepancies.

3. Sanctions and ESG Compliance:

- Governments and international organizations are beginning to impose sanctions and regulations related to ESG violations. For example, if a company is found to be linked to human rights violations or environmental degradation, they may face financial penalties, and their ability to access capital markets may be restricted.

- Sanctions targeting companies or nations based on ESG-related issues (e.g., human rights violations, environmental destruction, etc.) are becoming more common, and financial institutions must ensure they comply with these measures to avoid inadvertently facilitating financial crime.

Example:

A multinational mining corporation operates in a developing country and is found to be dumping toxic waste into rivers, causing severe environmental damage and health issues for local communities. Despite warnings, the company continues its harmful practices to save costs.

Sanctions Imposed:

Environmental Sanctions:

- The company is fined millions of dollars by the local government for violating environmental laws.

- The government suspends the company’s mining licenses until remedial actions are taken.

Investor Actions:

- Global institutional investors, such as pension funds or ESG-focused funds, divest from the company due to its poor ESG performance.

- The company is excluded from major ESG indices (e.g., Dow Jones Sustainability Index or FTSE4Good Index).

Trade Sanctions:

- International bodies or foreign governments impose trade sanctions, restricting the company’s exports or imports of raw materials.

Reputational Damage:

- Non-Governmental Organizations (NGOs) and activists lobby against the company, leading to a loss of business partnerships and contracts.

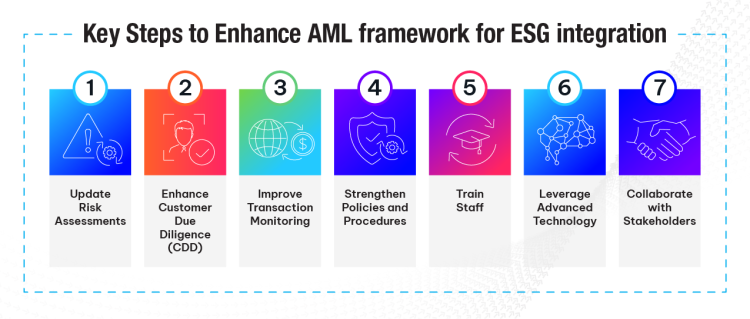

Key Steps to Enhance AML framework for ESG integration

1. Update Risk Assessments

- Incorporate ESG Risks: Enhance AML assessments to include managing ESG risks such as money laundering tied to environmental crimes (e.g., illegal logging, mining, or waste trafficking) or governance risks (e.g., corruption in sustainable development projects).

- Use ESG Metrics: Leverage ESG metrics and sustainability ratings to identify higher-risk clients or transactions linked to ESG non-compliance.

2. Enhance Customer Due Diligence (CDD)

- Screen for ESG Risks: Extend CDD and Enhanced Due Diligence (EDD) to assess clients’ ESG practices, such as their involvement in industries associated with environmental harm, human rights violations, or weak governance.

- ESG-Specific Questions: Include ESG-specific questions in onboarding and monitoring processes to evaluate clients’ adherence to ESG standards.

- High-Risk Industries: Pay closer attention to industries like fossil fuels, mining, and agriculture, which are more prone to ESG and AML risks.

3. Improve Transaction Monitoring

- Focus on ESG Risks: Modify transaction monitoring systems to flag suspicious activity associated with ESG risks, such as sudden fund flows to jurisdictions known for environmental crimes.

- Integration with ESG Data: Use external ESG data providers to enrich transaction monitoring systems, helping to identify risks associated with supply chains, human rights abuses, or environmental violations.

4. Strengthen Policies and Procedures

- Update AML Policies: Integrate ESG considerations into AML policies to address emerging risks tied to environmental crimes, unethical labor practices, or poor governance.

- Develop ESG-Aligned AML Standards: Align AML policies with global ESG frameworks, such as the UN Principles for Responsible Banking (PRB), the UN Global Compact, and the Task Force on Climate-Related Financial Disclosures (TCFD).

5. Train Staff

- ESG Awareness: Train AML and compliance teams on identifying and addressing ESG-related money laundering risks.

- Case Studies: Provide real-world examples of money laundering schemes involving ESG violations, such as environmental crimes or corruption in ESG investments.

6. Leverage Advanced Technology

- AI and Machine Learning: Use AI tools to analyze ESG-related data alongside traditional AML indicators to detect patterns of money laundering linked to ESG risks.

- Blockchain Technology: Explore blockchain for increased transparency in tracing funds, especially in sustainable finance or green bonds, to ensure their legitimate use.

7. Collaborate with Stakeholders

- Public-Private Partnerships: Partner with regulators, law enforcement, and NGOs to share data and insights on ESG risks and financial crime.

- Industry Collaboration: Engage with industry groups and initiatives focusing on ESG and AML integration to stay ahead of regulatory expectations.

Conclusion

ESG considerations and links with financial crime will only grow over the foreseeable future. The increasing regulatory focus on ESG Risk Management, especially within the EU (followed closely by APAC countries quickly catching up) is already translating into more thorough CDD processes and analysis.

By carefully reviewing their financial crime framework and taxonomies, Financial Institutions can pinpoint specific areas that are linked to ESG risks and may require improvement in terms of integration and gap coverage. In many FIs this could also require a cultural transformation as it require the use of non-traditional data, processes, systems, and skills.

The speed at which ESG risks have emerged and linked with economic crime is just another reminder of how criminal activity adapts incredibly quickly to the evolution of societies, using the drivers from that same evolution e.g. advanced technologies, globalization of economy or democratization of data to its own advantage. Lastly, this also highlights [yet again] the need for actors such as governments, regulators, FIs and solution providers to work closely together and break traditional data, policy, and cultural silos.

How NICE Actimize Professional Services can help

It is expected that non-financial risks stemming from poor ESG practices will become increasingly ‘mainstream’ in the industry and equally important to decision makers as addressing exposure to financial crime e.g. environmental crime generates around USD c.110 – 280Bn in criminal gains each year, covering a wide range of unlawful activities such as illegal logging, illegal wildlife trade and waste trafficking.

Assuming that a significant portion of those proceeds of crime are likely being laundered, FIs will need to review their processes, especially around CDD and Transaction Monitoring in order to identify potentially suspicious actors or activity hidden beneath transactions or along the customers relationships and supply chain.

Actimize Professional Services has a range of services and staff equipped with the expertise needed to perform ESG risk assessments, review and advise on underlying processes so any increase of investigative workload can be assimilated smoothly, minimizing so FIs remain efficient and compliant with ESG regulatory requirements.

Let us help you on your Operational Efficiency journey and achieve sustainable success. Contact us today to schedule a consultation and learn how our industry expert team can assist you in:

- Review your current policies, operations processes, and standing procedures

- Identify areas for improvement

- Setting realistic, measurable goals

- Integrate best industry practices

- Driving continuous improvement

- Enhance competitiveness

1The term ESG was first coined in a 2004 United Nations report titled “Who Cares Wins” (after the famed British Army Special Air Service or SAS Regiment motto “Who Dares Wins”). The United Nations Environment Program Finance Initiative, “Who Cares Wins”, 2004, https://www.unepfi.org/fileadmin/events/2004/stocks/who_cares_wins_ global_compact_2004.pdf