Checkmate: FAQs about Check Fraud with the Frontline Players on the Board

August 12th, 2024

Check use might have decreased, but check fraud attempts and losses are growing. NICE Actimize’s 2024 Fraud Insights Report found that check fraud grew by 4% by volume and 31% by value year over year.

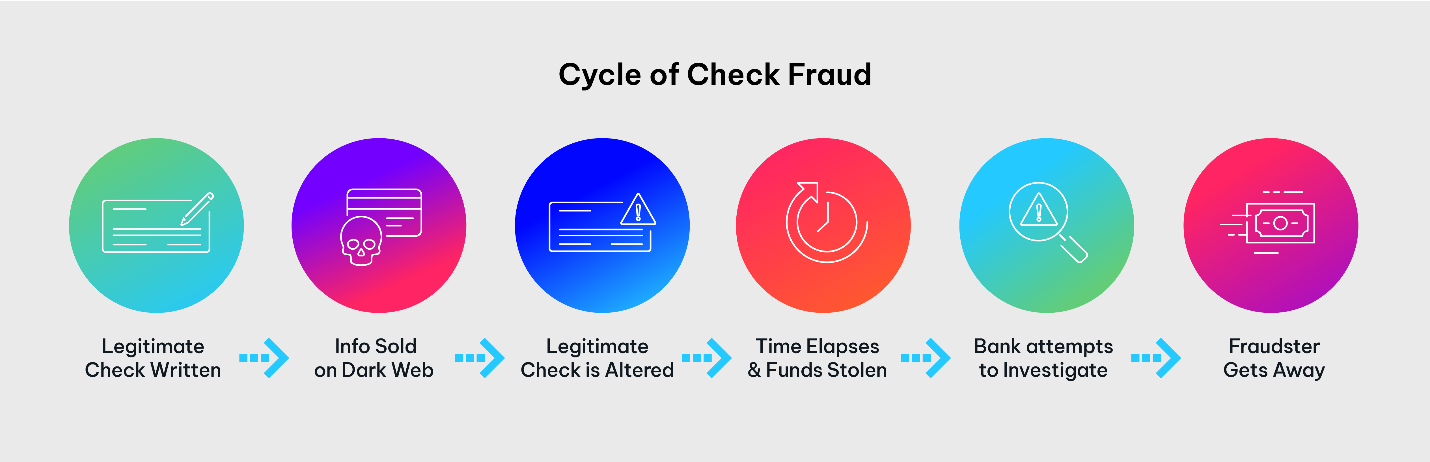

This increase is attributed to the multiple means in which checks can be altered or manipulated, and how long it takes to detect suspicious behavior. When combined with lack of innovation in check payments, these weaknesses open the door to more fraud.

In this blog, these practitioners and experts from different FIs offer their unique perspectives on why check fraud is increasing and what can be done to proactively mitigate it:

- Kristin Hines, Fraud Strategy Officer at Gate City Bank

- Panelist 2, Product Leader at a Top 5 U.S. Retail Bank

- John Ravita, Director of Business Development at SQN Banking Systems

They collectively bring over 40 years of financial services experience and discuss check fraud evolution, and its ongoing impact.

Alarming Uptick in Check Fraud

Check fraud in the US is exploding. Since 2020, there has been an increase of over 100% year-over-year, with no sign of slowing. How will FIs combat this onslaught of fraud using checks? One of the simplest, most cost-effective ways is by sharing knowledge, such as best practices, use cases, success stories and failures, with internal stakeholders, law enforcement, and especially other FIs.

Experts Weigh in on Check Fraud in Q/A

Q: What do you believe is causing the increase in check fraud?

Kristin Hines: Significant increases in mail fraud, by outsider perpetrators but also by internal postal employees, is driving at least part of the increase in check fraud. Mail fraud has become an extremely organized crime, to the point where it is being carried out by gangs or gang-like groups.

Panelist 2: The passage of time can also be attributed to the increases; checks are a baseline payment method that have been around for decades. Fraudsters have had a considerable amount of time to perfect their means of execution and create multiple points of entry due to the lack of innovation with checks.

John Ravita: The global pandemic really seemed to pour gasoline on the fire that is check fraud. On any given day, you can find tens of thousands of pieces of personally identifiable information (PII) available for sale on the dark web, most of which are checks. So, the supply is ample and unfortunately so is the demand. It also doesn’t help that it costs roughly $4.25 to investigate every dollar of fraud. So, the means of even attempting to combat check fraud just aren’t there, especially for smaller institutions.

Q: What tactics are fraudsters using the most when attempting to commit check fraud?

Kristin Hines: We are seeing a lot of counterfeit checks that stem from scams that people are falling victim to. Consumers get roped into investment scams where they give large sums of money to nefarious individuals, and then they are sent checks as part of the scam that will never clear. So, these fraud attempts are now also tied to scams, making them that much more complicated when it comes to tracking and intervening.

Panelist 2: For us, alterations are becoming more and more pervasive. Fraudsters are taking what is a good check and making it a fraudulent check by changing the pay to name, the amount to be paid, or something else. There are so many resources readily available that make alterations so easy to execute now. Anyone can get the tools they need and start altering checks within the matter of a few days.

What risks and challenges does check fraud present to financial institutions?

Kristin Hines: For small institutions, one of the biggest challenges is the lack of technology, either in terms of availability or tech advancements. This lack of technology creates a very narrow window, roughly 24 hours, for us to return a check as counterfeit. If we wait too long, we risk creating a negative consumer experience, so you really must find that sweet spot for both the institution and the consumer.

Panelist 2: I will echo what Kristin said regarding the balancing act of ensuring a positive consumer experience but also being diligent. It seems that the faster and more competitive that we all get, the more we put ourselves (the FIs) at risk.

Q: What are some best practices and technology that FIs can implement to combat check fraud?

Kristin Hines: Investment in training, both for front-end employees but also for consumers, is something that every institution should implement and that we have found vast success in. Training often has little to no cost but can save thousands or even millions if your front-end staff knows what to look for and has the confidence to call it out in an appropriate manner.

Panelist 2: Outside vendors play a key role in best practices. We cannot do this alone, so we all rely heavily on the solutions that they provide. Applying and keeping pressure on them is key to ensuring that they are bringing the best technology to us in a quick and accessible manner. A key piece of technology being one that gives us the ability to identify check fraud and interject in real-time.

John Ravita: Many banks, particularly smaller ones, have been deprived of technology. Evaluating check fraud is confined to a manual environment, meaning that only checks for large amounts even get a microcosm of the attention that they should. We are essentially sending smaller FIs into a knife fight with both hands tied behind their backs. That is why bringing in things like adaptable machine learning and outside data for means of comparison and storytelling is crucial. Having the right technology enables you to give your time and attention to the checks and instances that truly require it.

Q: What sort of regulations can or should be implemented if any?

Kristin Hines: Not sure if it could be enforced via regulation but data sharing between financial institutions would help immensely. Creating an easy to execute and secure means so that FIs can look out for each other the way they do their consumers would be amazing.

Panelist 2: Make it that all checks need to be printed in color. I know that getting vendors onboard to implement this would take some lifting but even a simple aesthetic change would help to hinder at least some fraud attempts.

John Ravita: Determining who is the responsible party when it comes to reconciling check fraud. It is unclear as to whom shoulders responsibility; the consumer, the sending bank, or the receiving bank and when it comes time to make it right. There is no black and white answer, and everyone just ends up losing, especially the consumer.

Q: How should we involve the consumers in the fight against check fraud?

Kristin Hines: Implementing the use of Positive Pay for consumers like what we currently do for commercial. Their behavior when it comes to remitting checks would not have to change much, they would just need to be given checks with Positive Pay and some type of enforcement to use them.

Panelist 2: I would also add making a push to digital payments, especially with the demand for it coming from younger generations. The sooner we get people and businesses to adopt digital payment methods, the better, despite the risks that also come with that method of payment.

John Ravita: Banks need to be upfront with consumers in letting them know that they have a responsibility to help in fighting check fraud just as much as the FIs do. However, we cannot even begin to involve the consumer without the FIs taking the first step. It all starts with the banks, most of them when you visit their website make no mention about check fraud and what to be mindful of.

Q: What do you predict will happen with checks and check fraud in the next 5-10 years?

Kristin Hines: Unfortunately, without significant advancements and investments in technology, I don’t foresee this issue going away. This has been and will continue to be an issue that is unique to North America. It will only go away if we make a significant push to online payment methods but even that has its own risks.

Panelist 2: The use of checks will likely continue to go down, but fraud will continue to rise. We have several great options to, at the very least, hinder some fraud attempts as previously mentioned like colored checks and Positive Pay. It’s just a matter of getting those implemented on a wide scale and foreshadowing how fraudsters can circumvent those innovations because we all know they will try.

Catch Check Fraud Faster

Traditional fraud monitoring rules and methods are inefficient when it comes to catching and intervening in check fraud. NICE Actimize’s Check Fraud solutions enable FIs to reduce false positives and increase detection accuracy, all while improving operational efficiency. Don’t wait for outdated methods to catch up to modern threats. Act now and get ahead of check fraud. Protect your institution and safeguard customers’ financial well-being with a modern solution for check fraud. Visit us online to learn about NICE Actimize’s check fraud solution tailor-made for mid-market and small institutions and enterprise institutions today.