Digital Communications Storage is Finally Moving to the Next Level

June 21st, 2024

As costs related to compliance rise and budgets compress across the financial services industry, technology end users are demanding more use cases for applications. In the case of digital communications, end users have traditionally sent communications data into archiving systems and left it there untouched. However, as regulatory requirements tighten for banks and other firms, and regulators are cracking down with massive recordkeeping fines, archiving solutions need to do more than just “set it and forget it.”

What’s Missing?

The use of digital communications archiving solutions is nothing new. Financial services firms have always needed to retain data to remain compliant. However, this need has grown substantially in recent years, as regulated users began working remotely in 2020 and continue to work on a hybrid schedule today.

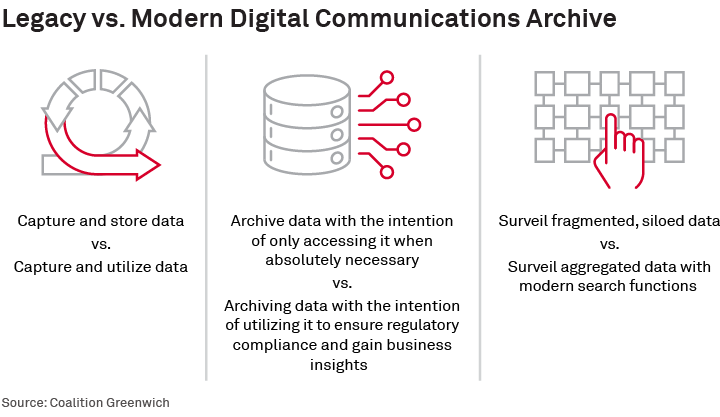

Providers of data archiving solutions have long focused on retention. Years ago, this was the right approach, as institutions just needed to hold on to information for a certain number of years. However, today’s compliance standards require firms to also be able to pull insights from this data to understand more about employee behavior, conduct risks and so on. Firms that implement data archiving solutions that can extract insights from stored data have a competitive advantage over firms with legacy systems.

Today’s technology should satisfy as many compliance gaps as possible. For instance, financial services firms with regulated users should be able to safely store and access a variety of enterprise data, including electronic communications, voice, video, chat and more. As legacy technology was not designed to store data coming from multiple communication sources, the information in these systems tends to be siloed, fragmented, and difficult to access.

Cost efficiency—or lack thereof—is another piece of this story. As more communications channels are added, the number of solutions has ticked higher in tandem, increasing costs. Legacy storage architecture drives up expenses due to inefficiency, compared to modern technology like the cloud. Firms have an opportunity to bring all their data together in a cloud storage technology that can lower costs lower by as much as 20%, resulting in millions of dollars in savings for global banks.

The Future of Archiving

Given the emergence of modern communication channels, firms should look to implement solutions that go beyond simple archiving. Next-generation digital archiving solutions should be able to not only securely store communications data in one system, but also to surveil that data, providing automated monitoring and seamless data search and extraction—saving time and improving efficiency.

A Glance into the Future

Keeping records of emails, chats, voice, and other forms of communication must happen—regardless of where they originate. There are regulations in place to ensure firms have strict policies around data archiving. However, when needed, firms must have the ability to quickly access that data as well.

Audits happen, and when they do, compliance professionals should spend very little time extracting reports or analyzing their data insights. Here’s how to ensure that happens:

- Ability to search using a key word or words across all forms of communications simultaneously. Imagine typing in a name and seeing all records related to that name, regardless of origin, in real time.

- Advanced search capabilities to find joined words/phrases across terabytes of information (e.g., “confidential” and “buy”).

- Identification of words with the recognition of synonyms or phrases that essentially share a meaning with the criteria (e.g., “confidential” and “private”).

- Flexibility to set up different groups for certain policies. For instance, one group may need access to the video archive, while another needs access to the chat archive.

Conclusion

As compliance budgets continue to tighten, industry professionals need to look for ways to streamline processes and optimize resources across technology stacks. To do this, an end-to-end compliance solution is key. Compliance heads should look to a technology vendor that can capture all communications data from every traditional and emerging communication channel, archive that data in one solution, and be able to perform advanced surveillance on that data to spot conduct risks.

Investing in technology that ensures data can be recorded, archived and surveilled in one solution will enable firms to lower costs, streamline processes, and avoid regulatory risks.

Coalition Greenwich, a division of CRISIL, an S&P Global Company, is a leading global provider of strategic benchmarking, analytics and insights to the financial services industry.

We specialize in providing unique, high-value and actionable information to help our clients improve their business performance.

Our suite of analytics and insights encompass all key performance metrics and drivers: market share, revenue performance, client relationship share and quality, operational excellence, return on equity, behavioral drivers, and industry evolution.

About CRISIL

CRISIL is a leading, agile and innovative global analytics company driven by its mission of making markets function better. It is majority owned by S&P Global Inc., a leading provider of transparent and independent ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide.

CRISIL is India’s foremost provider of ratings, data, research, analytics, and solutions with a strong record of growth, culture of innovation, and global footprint.

It has delivered independent opinions, actionable insights and efficient solutions to over 100,000 customers through businesses that operate from India, the U.S., the U.K., Argentina, Poland, China, Hong Kong, and Singapore.

For more information, visit www.crisil.com

Disclaimer and Copyright

This Document is prepared by Coalition Greenwich, which is a part of CRISIL Ltd, an S&P Global company. All rights reserved. This Document may contain analysis of commercial data relating to revenues, productivity and headcount of financial services organisations (together with any other commercial information set out in the Document). The Document may also include statements, estimates and projections with respect to the anticipated future performance of certain companies and as to the market for those companies’ products and services.

The Document does not constitute (or purport to constitute) an accurate or complete representation of past or future activities of the businesses or companies considered in it but rather is designed to only highlight the trends. This Document is not (and does not purport to be) a comprehensive Document on the financial state of any business or company. The Document represents the views of Coalition Greenwich as on the date of the Document and Coalition Greenwich has no obligation to update or change it in the light of new or additional information or changed circumstances after submission of the Document.

This Document is not (and does not purport to be) a credit assessment or investment advice and should not form basis of any lending, investment or credit decision. This Document does not constitute nor form part of an offer or invitation to subscribe for, underwrite or purchase securities in any company. Nor should this Document, or any part of it, form the basis to be relied upon in any way in connection with any contract relating to any securities. The Document is not an investment analysis or research and is not subject to regulatory or legal obligations on the production of, or content of, investment analysis or research.

The data in this Document may reflect the views reported to Coalition Greenwich by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Coalition Greenwich compiles the data received, conducts statistical analysis and reviews for presentation purposes to produce the final results.

THE DOCUMENT IS COMPILED FROM SOURCES COALITION GREENWICH BELIEVES TO BE RELIABLE. COALITION GREENWICH DISCLAIMS ALL REPRESENTATIONS OR WARRANTIES, EXPRESSED OR IMPLIED, WITH RESPECT TO THIS DOCUMENT, INCLUDING AS TO THE VALIDITY, ACCURACY, REASONABLENESS OR COMPLETENESS OF THE INFORMATION, STATEMENTS, ASSESSMENTS, ESTIMATES AND PROJECTIONS, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE ARISING OUT OF THE USE OF ALL OR ANY OF THIS DOCUMENT. COALITION GREENWICH ACCEPTS NO LIABILITY WHATSOEVER FOR ANY DIRECT, INDIRECT OR CONSEQUENTIAL LOSS OR DAMAGE OF ANY KIND ARISING OUT OF THE USE OF ALL OR ANY OF THIS DOCUMENT.

Coalition Greenwich is a part of CRISIL Ltd, an S&P Global company. ©2024 CRISIL Ltd. All rights reserved.