Realizing the Potential of Operational Efficiencies in an AML Program

June 17th, 2024

In the dynamic and complex landscape of today’s financial environment, Anti-Money Laundering (AML) initiatives are essential strategic safeguards. Yet, crafting AML measures that are both effective and efficient can be daunting, hindered by manual processes, fragmented data, and scarce resources. The key lies in striking a balance between efficacy and efficiency, which is pivotal in this domain and necessitates operational finesse. Institutions can fortify their compliance stance and reap substantial rewards by refining AML processes and embracing technological advancements. The crux of success hinges on the delicate equilibrium between the program’s effectiveness and its operational efficiency. This paper delves into strategies for enhancing your AML program, ensuring it bolsters your efforts without straining your resources.

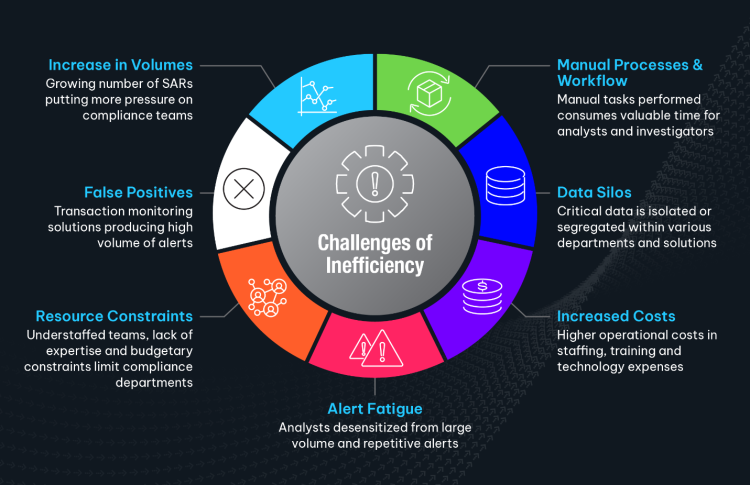

The Challenges of Inefficiency

Suboptimal procedures in a Bank Secrecy Act/Anti-Money Laundering (BSA/AML) framework can create substantial obstacles for financial institutions. Such difficulties affect not only adherence to regulatory mandates but also heighten the potential for risks and diminish operational effectiveness. Here’s an in-depth look at the key challenges many organizations may face. Given the multitude of elements influencing an entity, it’s probable that several organizations have faced one or more of these issues concurrently, exacerbating the consequences of operational inefficacy

Increase in Volumes

Suspicious Activity Reports (SARs) have shown a tremendous upward trend over the past three (3) years. This trend could be linked to a variety of reasons, including a spike in financial crimes, heightened vigilance by regulators, and the global integration of financial markets, which has made it easier for criminals to transfer funds internationally. The growing number of SARs each year is putting more pressure on compliance teams. Moreover, outdated, and inefficient processes are making it increasingly difficult to manage the rising volume of SAR filings, as this uptick leads to more cases to investigate, and a growing flood of alerts generated by systems.

Manual Processes and Workflows

Tedious, and often repetitive tasks within customer onboarding (KYC) and transaction monitoring consume valuable time for analysts and investigators in financial intelligence units (FIUs). Manual tasks can include something as simple as copying and pasting data into the transaction monitoring solution, manually assigning alerts or cases and even complete steps conducted outside the solution simply because the current process does not align with the workflow. These manual processes, whether few or many, detract from the time required to fully analyze and assess whether the activity in question is potentially suspicious and requires additional review.

Data Silos

Crucial to any FIU, the better the data the better the results. Often, BSA/AML departments experience data silos in which critical information resides in disparate systems. These silos occur when data is isolated or segregated within different departments or systems, hindering the ability to effectively monitor, detect, and report suspicious activities. Data silos can lead to incomplete customer profiles, as customer information is scattered across different systems. This can make it difficult to accurately assess customer risk and detect potentially suspicious activities. Also, data silos can hamper the effectiveness of transaction monitoring efforts. When transactional data is fragmented, it becomes challenging to identify patterns or anomalies that may indicate suspicious activity.

In addition, the use of multiple solutions by FIU team members to complete the work also creates additional challenges. Time to log into other systems, the possibility of transposing data and other factors may also negatively impact the operational processes.

False Positives

Inefficient processes generate excessive volume of alerts, overwhelming analysts, and delaying investigations. False positives can decrease the efficiency of BSA/AML programs by clogging the system with unnecessary alerts. Unfortunately, this can cause delays in handling legitimate suspicious activity alerts and even raise the risk of missing true positives. The sheer avalanche of false positives can swamp compliance teams, making it more likely that genuine suspicious activities slip through the cracks without proper investigation.

Resource Constraints:

BSA/AML compliance requires specialized expertise in financial crimes, regulatory requirements, and compliance best practices. A lack of expertise can hinder the effectiveness of compliance efforts and lead to errors in detecting and reporting suspicious activities. AML teams are often understaffed, making it difficult to keep pace with regulatory updates and evolving threats. These inefficiencies not only hinder effectiveness but also expose institutions to potential regulatory penalties and reputational damage.

Budgetary constraints can limit the resources available for BSA/AML compliance. This can impact the ability to invest in technology, training, and staffing needed to effectively manage compliance risks.

Increased Costs:

Inefficient operational processes such as manual reviews and investigations are time-consuming, requiring significant human resources. Additionally, the manual review of false positives can result in increased operational costs for financial institutions. These costs include staffing, training, and technology expenses associated with managing and resolving false alerts.

Higher costs in BSA/AML programs can lead to increased compliance risk. Financial institutions may cut corners or prioritize cost savings over compliance, leading to regulatory scrutiny and potential penalties.

Finally, the high costs associated with BSA/AML programs can impact the allocation of resources within financial institutions. Limited resources may be diverted from other areas, potentially leading to inefficiencies in other parts of the organization.

Alert Fatigue:

Inefficient systems generate a large volume of alerts, overwhelming analysts and hindering their ability to identify truly suspicious activity. Alert fatigue occurs when compliance analysts become desensitized to this large volume of alerts generated by transaction monitoring systems, leading to a higher likelihood of missing genuine suspicious activities.

An alternative factor may be seen in which compliance analysts receive repetitive alerts for the same type of activity, which can be monotonous and contribute to fatigue. This can also indicate underlying issues with the monitoring system that need to be addressed.

Another, yet unfortunate, possibility exists where compliance analysts may feel pressure to clear alerts quickly, which can lead to shortcuts in the investigation process and increase the risk of missing genuine suspicious activities.

Delayed Investigations:

Slow processes can delay investigations, allowing suspicious activity to continue undetected. Some alerts require complex analysis and investigation, which can be time-consuming. Compliance teams may need to gather additional information, review multiple transactions, and make enquiries, all of which can contribute to delays.

In addition, outdated or inadequate technology solutions can hinder the efficiency of investigations. Manual processes and limited automation can lead to delays in gathering and analyzing data. In large financial institutions with complex organizational structures, coordination and communication between different departments involved in investigations can be challenging, leading to delays.

Regardless of the above reasons, technology, resources, cost, or data, can have a negative impact on the operational efficiency of an organization. It is important to identify these areas that have the greatest effect while balancing the many constraints organizations are sure to encounter along the way.

Strategies for Enhancing your Program: Balancing Speed with Quality

On one hand, timely detection and reporting of suspicious activity are essential for combating financial crime. On the other hand, sacrificing accuracy for speed can lead to missed red flags or even false positives, hindering investigations, and wasting resources. To truly enhance efficiency, FIUs must identify areas which need improvement, leverage technology, and provide adequate training, ensuring a balance that allows FIUs to work smarter, not just faster.

Conduct a Thorough Review

Conduct a review of your existing AML Operations processes is paramount to understand where inefficiencies may exist. A comprehensive review involves evaluating the effectiveness of policies, procedures, and controls, as well as assessing the adequacy of resources and training. A thorough review can identify opportunities to streamline processes and improve operational efficiency within BSA/AML operations. This can lead to cost savings and better allocation of resources.

Identify Improvement Areas and Prioritize Gains

Identify areas for improvement and prioritize efficiency gains. By focusing on areas that offer the greatest potential for improvement, institutions can strengthen their BSA/AML programs, reduce compliance risks, and better protect against financial crimes. Identifying areas of improvement and prioritizing gains enables financial institutions to make more informed strategic decisions. By focusing on areas that align with their overall objectives, institutions can achieve greater success in combating financial crimes. One important point here to emphasize is in order to identify improvements you must be able to measure and track them. This can be accomplished by regularly assessing performance and identify areas for improvement which aids in defining your key performance indicators (KPIs) to measure operational efficiency.

Train on Investigation Techniques

Train your AML team on efficient investigation techniques and utilize data visualization tools. Proper training can enhance the efficiency and effectiveness of investigations, leading to better compliance outcomes and reduced risks for financial institutions. Training on investigation techniques also equips compliance professionals with the skills to identify red flags and patterns indicative of money laundering, terrorist financing, and other illicit activity. Paramount to training is being able to adapt to changing threats. Identifying these threats helps compliance professionals stay updated on evolving money laundering and terrorist financing trends and tactics. This enables them to adapt their investigation techniques to address new and emerging threats or even develop specialized skills in areas such as cryptocurrency, trade-based money laundering, and sanctions screening.

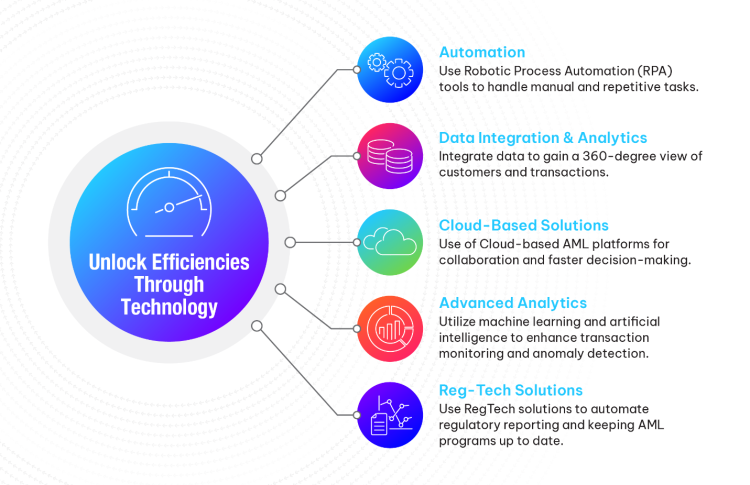

Unlock Efficiencies Through Technology

Invest in technology solutions that automate tasks and enhance data analysis. Fortunately, advancements in technology offer a path towards improved efficiency and effective AML program. Here are some key areas where technology can make a difference:

- Automation: Use Robotic Process Automation (RPA) tools to handle repetitive tasks like data extraction, document verification, and name screening. This frees up analysts’ time for higher-level investigations. Implement workflow automation tools to handle routine tasks such as data extraction, case assignment, and documentation.

- Data Integration and Analytics: By integrating data from various sources, institutions can gain a 360-degree view of customers and transactions, enabling more accurate risk assessments with fewer false positives. Artificial intelligence (AI) and machine learning (ML) can further enhance analytics by identifying patterns and anomalies indicative of suspicious activity. Leverage APIs and data connectors to pull relevant information from various systems.

- Cloud-Based Solutions: Cloud-based AML platforms offer scalability, accessibility, and real-time data access, enabling collaboration and faster decision-making.

- Advanced Analytics: Use machine learning and artificial intelligence to enhance transaction monitoring and anomaly detection. Predictive analytics can identify patterns and trends, improving risk assessment.

- RegTech Solutions: RegTech solutions can automate regulatory reporting and keep AML programs up to date with evolving regulations.

Benefits of an Efficient AML Program

Implementing an efficient AML program goes beyond just regulatory compliance. It offers a range of benefits:

Enhanced Detection and Investigation: Efficient processes allow AML analysts to focus on high-risk cases, improving the accuracy and effectiveness of transaction monitoring and suspicious activity detection. By streamlining workflows and leveraging data analytics, institutions can identify suspicious activity more effectively, leading to a proactive approach to money laundering risks.

Improved Resource Allocation: Improved staffing and resource allocation empower AML teams to proactively manage compliance risks, protect institutions, and maintain trust in the financial system. Automation frees up investigators’ time, allowing them to focus on complex cases and improve overall efficiency.

Cost Reduction: Streamlining processes and automating repetitive tasks can significantly reduce operational costs. By optimizing resource allocation, organizations can allocate their budget more effectively.

Improved Customer Experience: A streamlined KYC/CDD process means quicker onboarding for customers. This fosters trust and satisfaction, leading to a better overall customer experience.

Faster Response Times: Operational efficiencies enable quicker responses to alerts and investigations. This allows to initiate investigations quicker and disrupt criminal networks more effectively.

Operational Efficiency: Not a Luxury

Operational efficiency is no longer a luxury in the world of AML compliance; it’s a necessity. By embracing technology and streamlining processes, institutions can achieve a more robust and effective AML program while reaping the benefits of reduced costs, improved resource allocation, and a better customer experience. The future of AML lies in leveraging technology to its fullest potential, striking the right balance between effective compliance and operational efficiency.

Remember, the fight against financial crime requires continuous adaptation and innovation. Stay informed, collaborate, and evolve your AML program to stay ahead of emerging risks.

You can find out more about these and other services by scheduling a call with our subject matter experts who can recommend solutions based on your specific business needs. NICE Actimize is here to help you along your journey. To know more about our training and other advisory services, please go through our service catalog here.