Tackling KYC/KYB challenges with pKYC

June 6th, 2024

Know Your Customer (KYC) is essential, not only for anti-financial crime compliance but also for a smooth, positive customer experience, particularly during the onboarding phase. However, traditional, manual KYC practices often struggle to keep up with the fast-paced nature of banking and the complexities of onboarding corporate entities.

The challenges are especially pronounced in corporate onboarding, part of the process often referred to as Know Your Business (KYB). KYB is complex, as businesses are owned and controlled by individuals, often multiple individuals. Businesses can span multiple jurisdictions, including secrecy jurisdictions and changes to ownership structures, controllers or operating locations can be made quickly and with relative ease. To top it off, corporate entities can change their activity, the value and volume of activity or even expand and enter new markets without informing the financial institution, even if these changes heighten the risk of the business.

In response, financial institutions must move towards a perpetual KYC (pKYC) model. This ongoing approach ensures the customer is continually monitored for changes in customer information or activity which will materially change the customer risk, allowing firms to proactively manage compliance risk effectively, with speed and precision.

The Transition from Traditional KYC to pKYC

Traditionally, KYC relies on periodic verification at set intervals — often annually for high-risk customers or every three or five years for lower risk customers. Many organizations categorize clients as low, medium, or high risk, which determines how frequently their information needs revalidation.

This traditional KYC approach is increasingly inadequate, given the rich array of data available today, including third-party services like adverse media monitoring and internal data points like transaction logs.

Consider the risks if something significantly changes between the initial account setup and the next scheduled review. What if a material event, like a significant change in corporate ownership, alters a client’s risk profile? If this change goes unnoticed until the next review, potentially years later, the firm could unknowingly expose itself to new threats. This example highlights traditional KYC limitations, which depend on static, time-based reviews rather than real-time data monitoring.

Operationally, traditional KYC processes are time-consuming and inefficient. In this traditional model, it’s common for firms to contact clients individually to confirm if their information is still accurate or to provide evidence of changes. Because of the manual human effort required, it is both labor-intensive and costly.

These processes are also burdensome from the client’s perspective. Clients may be contacted multiple times to re-verify their information, sometimes by different departments within the same financial institution. Often, these departments might request duplicate information for different purposes. This repetitive contact is inconvenient and can lead to frustration, potentially damaging relationships or resulting in client attrition.

As the banking sector digitalizes and technologies like artificial intelligence (AI) continue to advance, firms are able to transition away from this traditional KYC approach. In its place, compliance teams are increasingly adopting pKYC practices that leverage automation and AI algorithms to analyze vast swathes of data and continuously monitor for changes in a client’s status or risk profile. This approach enables more efficient and real-time customer information management, fostering better and more robust compliance.

Distinguishing KYC from KYB in Client Onboarding

During onboarding, there are two categories of clients: retail (i.e., a person) and corporations. Each category requires different types of checks, as per regulatory requirements.

Retail

For individuals, financial institutions must complete KYC and collect and verify basic information on standard documents such as a national ID. Proof of address, occupation, and income is also often required. The FI will then verify the customer’s identity and screen the client’s names against various watchlists, finally determining their risk profile based on findings and analysis.

Corporate

For corporate clients, financial institutions must complete KYB and determine a business’s corporate structure, true nature, purpose, jurisdictions of operation and often expected activity. These checks can be more complex because they require a thorough understanding of the company’s corporate makeup, including parent companies and subsidiaries. They also require determining the ultimate beneficial owner (UBO), controllers and geographical risks.

In contrast to retail clients, verifying a corporate client can involve a broader range of documents or considerations. These include financial statements, incorporation or registration documents, annual reports, or tax records, depending on the nature of the business, its risk profile, and regulatory obligations.

One major difference between corporate and retail clients is the frequency of events that could alter their risk profile.

Due to the dynamic nature of business, corporate clients are usually subject to more regular and sometimes dramatic changes. For example, while a name or address change prompts a KYC update, it is relatively infrequent for an average person. In contrast, corporations may face shifts in operations, changes in ownership, or expansions in geographical reach as part of normal business, requiring more consistent KYB updates.

pKYC is particularly useful here. It strengthens the KYC and KYB process by continuously updating client information from internal and external sources and reducing reliance on periodic reviews. This approach is more practical and effective, as it facilitates real-time monitoring and allows firms to quickly detect and address potential risks like money laundering or fraud as they happen.

How pKYC transforms KYB

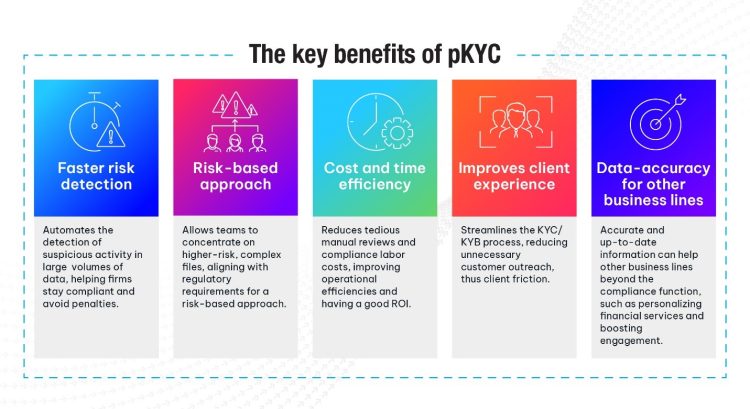

Implementing a perpetual and ongoing model to KYB processes has significant benefits:

Proactive Monitoring

Leveraging both public and private databases, such as corporate records, adverse media, global sanction lists, or transaction details, pKYC actively monitors for discrepancies like changes in the UBO or unusual business activity patterns. Once detected, it automatically alerts compliance teams. This proactive, automated approach allows for timely decision-making capabilities that can address the intricacies and rapid pace of change common with corporate clients.

Cost Efficiency in Onboarding

Automated monitoring and collection of customer information, the same process used in pKYC can also apply during customer onboarding. Because of its inherent complexity, the process of onboarding corporate clients can be more manual and expensive compared to retail clients. One report estimates that the time to complete KYB ranges between 18.5 hours and 62 hours, depending on the corporate structure. This is also reflected in the costs, where KYB costs approximately $311, compared to just $12 for a retail client.1 These high costs present a massive opportunity for more efficient and innovative solutions.

Operational Efficiency

Automation can significantly reduce manual labor, which are especially intensive during corporate onboarding. This in turn reduces operating expenses. For first-line defense teams like KYC, it alleviates heavy workloads and repetitive tasks, which are contributors significantly to employee burnout and retention. Automating data collection and risk assessment frees compliance teams to concentrate on higher-risk or more complex cases that require urgent attention. This strategic shift enhances efficiency and the overall effectiveness of risk management.

Minimizing Human Error

Human error can also be reduced using automation, as it commonly occurs in repetitive and tedious tasks. This means data quality is improved across the organization.

Improving Client Experiences

Clients benefit from a smoother, frictionless experience, as they are only contacted when truly necessary. In addition to avoiding redundant information requests, enhanced communication fosters client trust and operational efficiency.

Overall, pKYC’s event-driven approach streamlines the efforts of compliance teams, steering them towards risk-based analysis rather than unnecessary manual file reviews.

The Strategic Role of pKYC in Modern Compliance

Traditional KYC is outdated and no longer meets the demands of modern anti-financial crime compliance programs. By adopting a pKYC approach, financial institutions improve their risk management, particularly in the complex areas of KYB. This proactive, risk-based strategy is crucial for firms wanting to maintain compliance and efficiently manage the complexities of corporate customers and their associated risks.

For more information on NICE Actimize’s pKYC solution, go here.

[1] https://www.pwc.com/sg/en/consulting/assets/pkyc-a-new-approach-to-periodic-reviews.pdf