ISO 20022 101 for AML and Sanctions Screening Professionals

August 1st, 2022

Check out the previous blog ”What ISO 20022’s extra data means in the fight against fraud” to learn more about fraud challenges and opportunities.

Payment Message Basics

Every time you make a transaction using your credit or debit card, transfer funds to or from an account, or trade securities, a payment message is generated and sent to your transaction counterparty’s financial institution. These electronic messages inform the financial institution which account to credit or debit (including how much), and contains specific information on the transaction, the parties involved, and sometimes the purpose of the transaction.

Historically, payment message standards have been inconsistent, creating challenges for financial crime and compliance (FCC) teams when screening against payments and monitoring for suspicious behavior.

The New Global Messaging Standard is ISO 20022

ISO 20022 addresses these challenges as a new global standard for exchanging payment messages between financial institutions. ISO 20022 was first introduced in 2004 by the International Standards Organization (ISO) and is the successor of the ISO 15022 standard, which is frequently used by financial institutions today. By establishing an industry-wide language and standard message format that ensure payment messages are similar in structure and data language regardless of which financial institution is sending the message, the ISO 20022 standard strengthens financial crime prevention. This standardized structure:

- Increases transparency into the contents of each payment message

- Simplifies the extraction of rich data from payment messages—improving financial crime monitoring and detection

- Harmonizes several existing standards to increase interoperability across messaging formats, making it easier to “translate” between different message formats efficiently given your organization’s existing data structures

The Driver for Change—the SWIFT MX Message Standard

Today, over 10,000 financial institutions worldwide use the Society for Worldwide Interbank Financial Telecommunication (SWIFT) MT message standard for payments. Even after SWIFT introduced the more advantageous, ISO 20022-compliant MX Message Standard, the MT standard remained predominant for two main reasons, namely:

- Its prevalence when ISO 20022 and the MX standard were introduced

- The need for Financial institutions to modify existing processes and systems to use the new ISO standard

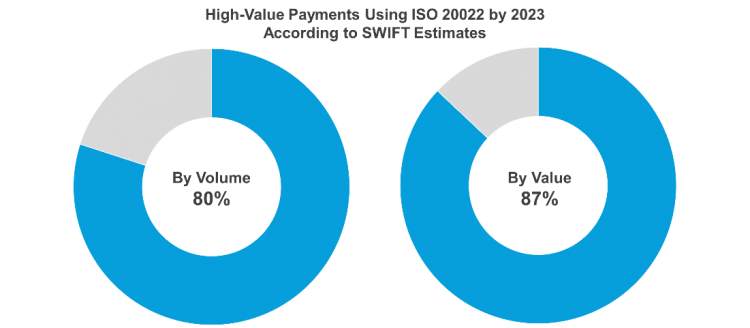

The drive to switch to ISO 20022 has only just begun in the last few years after SWIFT announced plans to retire the MT message standard. Financial institutions must now update their systems to be compatible with ISO 20022 and MX messages. SWIFT estimates that 80% of high-value payments by volume and 87% by value will have migrated to ISO 20022 by 2023.

ISO 20022 Implementation Timeline

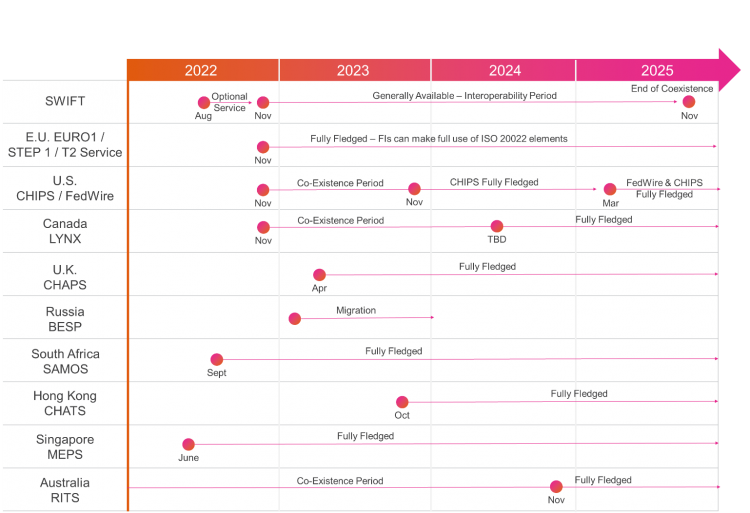

SWIFT plans to transition to the MX message standard starting in August 2022, fully replacing the MT message standard by 2025. During the transition period between 2022 and 2025, financial institutions can leverage both standards, and organizations will receive both an MT and MX version of each message. Any messages originating with the MX format will be truncated to create the MT message version.

Implementation timelines for ISO 20022 will be different for each financial institution. When deciding upon an implementation timeline, FIs should consider how their local examiners will view the data “loss” resulting from MT message truncation and if this truncation should impact their timeline.

As long as their transition aligns with the timelines of their central bank and local payment systems and they address examiner concerns, financial institutions can transition any time before late 2025. For example:

- The U.K.’s CHAPS payment system will start using ISO 20022 in April 2023, so institutions receiving payments from CHAPS must be capable of receiving ISO 20022 payments by spring of 2023

- In the U.S., banks have more time to implement the new standard with the CHIPS system starting ISO 20022 in November 2023

The Benefits of ISO 20022

For Screening Teams

The standard message format makes it easier to screen against payment messages for sanctioned or embargoed entities, politically exposed persons (PEPs), and sanctioned goods and ports by allowing screening systems to extract richer data from free text messages. institutions to confidently discount unnecessary fields, reducing false positives and noise, while continuing to screen against fields with useful data.

Clear data extraction enables financial institutions to expand their system’s coverage by screening against fields that previously contained incomplete or disjointed information under other message standards. With reduced false positives and increased coverage, ISO 20022:

- Minimizes erroneous matches

- Reduces friction for good payments

- Improves customer experiences for customers making legitimate payments

For Transaction Monitoring Teams

The structured data format of ISO 20022 makes it easier for transaction monitoring systems to extract rich and consistent text from payment messages and the use extracted data in the monitoring and detection of money laundering typologies. Transaction monitoring teams should consider adding new models to their transaction monitoring system to take advantage of the extra information now included in payment messages.

Looking Forward

With the ISO 20022 message standard’s clear, uniform message language and format, it’s much easier for financial institutions to both communicate outgoing payment message details and understand details of incoming or transient payments.

For FCC teams, this new standard means easier monitoring and detection of financial crime risk and stronger sanctions compliance. FCC teams should look to understand the transition plans of all major payment systems they use to establish implementation timelines and ensure compliance systems are ready for the new standard.

Learn more about ISO 20022 and its impact on payment screening requirements in this article.